The local stock barometer yesterday moved closer to record-highs as investors digested a string of local corporate earnings reports.

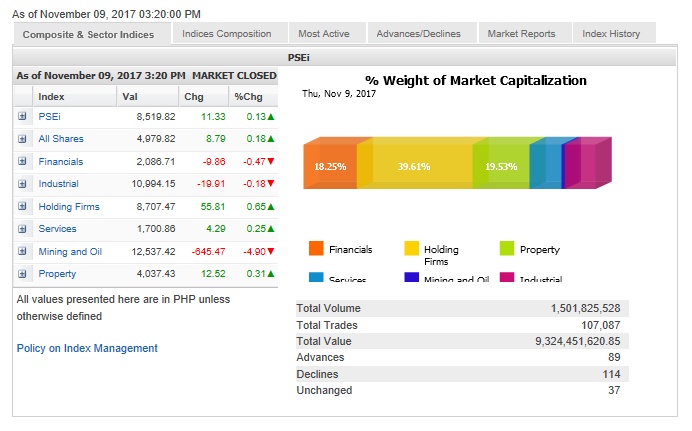

The main-share Philippine Stock Exchange index added 11.33 points or 0.13 percent to close at 8,519.82.

“US stocks struggled to gain traction in positive territory late Wednesday, as investors awaited updates on efforts to pass tax reform in Washington and as President Donald Trump toured Asia, highlighting lingering tensions with North Korea in a speech. Meanwhile, the buying momentum continued with the PSEi trading at record highs once again ahead of the Asean Summit and more earnings announcements,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

In addition, the Bangko Sentral ng Pilipinas is expected to keep its key interest rates unchanged.

The PSEi was led higher by holding firms, services and property counters while the financial, industrial and mining/oil counters tumbled.

Value turnover for the day amounted to P9.32 billion.

There were 114 decliners that overwhelmed 89 advancers while 37 stocks were unchanged.

The PSEi was led higher by SM Prime and Globe Telecom, which both added more than 1 percent while Meralco, SM Investments, Jollibee, Ayala Land, GT Capital and PLDT also firmed up.

Outside of PSEi, notable gainers included Italpinas, which surged by 37.7 percent on the rumored entry of a new investor.

Bloomberry likewise gained 3 percent after releasing robust third quarter results.

On the other hand, Semirara fell by 7.89 percent while Megaworld tumbled by 2.57 percent.

URC and Metrobank both slipped by over 1 percent. Ayala Corp., BDO, Metro Pacific and BPI also faltered.

One notable decliner outside PSEi was Global Ferronickel, which tumbled by 6.58 percent.

Ginebra San Miguel also slipped by 3.89 percent, on profit-taking after the recent surge related to the consolidation of the group’s food and beverage business into Purefoods.