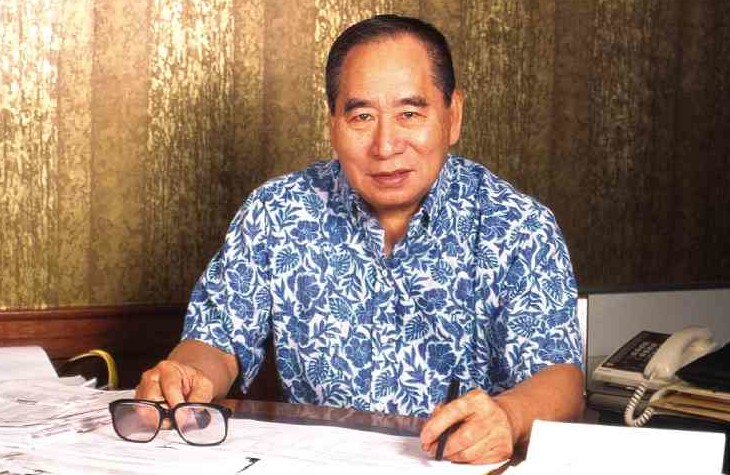

SM founder HENRY Sy Sr.

The country’s largest conglomerate SM Investments Corp. grew its nine-month net profit by 8 percent year-on-year to P23.8 billion on higher earnings across its retailing, property and banking businesses.

Excluding one-off items, SMIC’s recurring net income rose by 13 percent year-on-year on the back of an 8-percent growth in consolidated revenues to P272.2 billion for the first nine months.

“Our solid third quarter results benefitted from vibrant growth in our property and retail businesses. Property earnings were driven by nationwide mall expansion and the strong performance of residential developments. Retail also gained from footprint expansion and robust consumer sentiment, particularly in specialty retailing. We remain confident that our growth plans are on track,” SM president Frederic DyBuncio said in a press statement.

For the first nine months, property accounted for 40 percent of consolidated earnings while banks accounted for 38 percent and retail had a share of 22 percent.

Retail operations under SM Retail Inc. grew net income by 10 percent year-on-year to P7.7 billion as total sales rose by 6 percent to P197.9 billion for the period. Revenues from specialty retail increased by 9 percent year-on-year.

The department store unit “The SM Store” two stores in Cagayan de Oro and in Puerto Princesa during the nine-month period. Total gross selling areas of all 59 department stores stood at over 750,000 square meters.

The food retail group also continued its aggressive expansion, adding 21 mid-sized format Savemore stores, three SM Supermarkets and two WalterMart stores for a total of 26 new stores year-to-date. Most of these new stores were located in communities outside Metro Manila. Meanwhile, convenience store arm Alfamart increased its number of stores to 320 as of end-September from 210 at the start of the year. Specialty Retail added 68 new stores during the nine-month period.

It was earlier reported that property arm SM Prime grew its net income by 15 percent year-on-year to P20 billion, driven by additional rental revenues from mall expansions, consistent growth in same-mall-sales and higher contribution from residential sales.

BDO Unibank, on the other hand, earned P20.4 billion, up by 5 percent, as the bank expanded its core lending, deposit-taking and fee-based businesses.