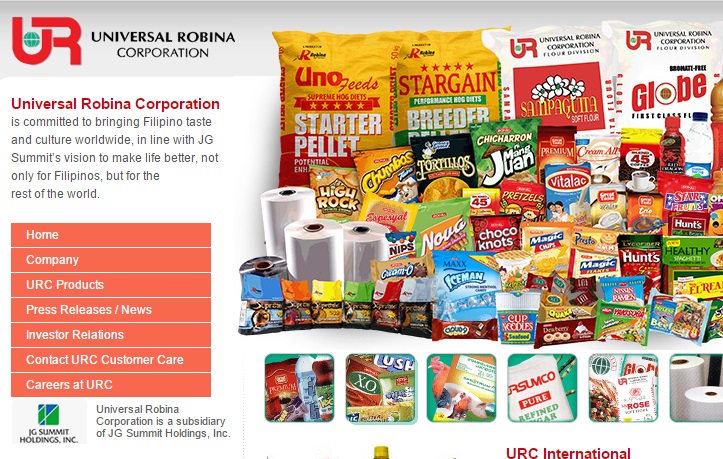

SCREENGRAB from www.urc.com.ph

Gokongwei-led Universal Robina Corp. saw a 21.8-percent year-on-year decline in nine-month net profit attributable to equity holders of parent firm to P8.21 billion as the industrial giant grappled with cutthroat competition in the domestic coffee business, lower foreign exchange gains and higher finance costs.

Nine-month operating income decreased by 7.4 percent year-on-year to P10.77 billion, weighed down by the decline in domestic branded consumer food business.

In a regulatory filing on Tuesday, URC said consolidated sale of goods and services had risen by 13.1 percent year-on-year to P92.415 billion for the nine-month period on higher earnings from its branded consumer food business.

Domestic operations of its branded consumer food business saw a 1.4-percent decline in net sales to P43.692 billion for the nine months. URC said that the strong performance of snackfoods and joint ventures, including the recovery of ready-to-drink beverages, was offset by the underperformance of beverages due to intense competition in coffee categories.

The international operations of its branded consumer food reported a 38.9-percent increase in net sales to P31.23 billion for the nine-month period. In US dollar terms, sales increased by 29.9 percent year-on-year to $622 million for the nine months, with growth coming from sustained double-digit growth in Thailand, strong domestic performance in Malaysia and sales contribution from Snackbrands Australia, which the group started consolidating into URC International starting October.

Business in Thailand saw double-digit growths from snacks and wafers, significantly higher export sales of candies, biscuits and chocolates, which was driven by key marketing activities for the period and strengthened distribution capabilities.

URC’s Malaysian business also increased from higher domestic sales of snacks, confectionery and biscuits all posting double-digit growths.

The agro-industrial segment also grew revenues by 8.9 percent year-on-year to P7.44 billion for the first nine months. The feeds business slightly increased by 3.1 percent as sales of dogfood and gamefowl feeds offset the slowdown in sales resulting from lower demand for hog feeds. The farm business expanded by 16.5 percent year-on-year, driven by higher prices of swine and poultry products and higher volume for fresh meat and carcass.

URC’s commodity business expanded by 24.2 percent year-on-year to P9.06 billion. The sugar business increased by 54.1 percent due to higher sales volume of raw and refined sugar despite decline in prices while renewables business increased by 18.2 percent mainly coming from higher volume. The flour business declined by 6.2 percent due to lower prices and volume due to soft

market conditions.

Meanwhile, net foreign exchange gain declined to P768 million compared to P1.73 billion in the same nine-month period last year due to the combined effects of the depreciation of international subsidiaries’ local currencies and Philippine peso vis-à-vis US dollar. URC’s finance costs – consisting mainly of interest expense – increased by 49.6 percent year-on-year to P1.07 billion as the company’s debt stock increased.

URC’s cost of sales – consisting primarily of raw and packaging materials costs, manufacturing costs and direct labor costs – increased by 15.7 percent to P64.126 billion for the nine months of 2017 due to higher input costs.

Selling and distribution costs, alongside general and administrative expenses, also rose by 19.2 percent to P17.52 billion for the nine-month period.