Fuelled by higher economic growth in the region, air traffic is expected to rise by 7.2 per cent a year until 2036 and this will see airlines expand their fleets to better serve demand, Jim Freitas, managing director, product marketing and analysis Boeing Commercial Airplanes, told a group of Thai and foreign journalists in Seattle.

Regarding global aviation market trends, growth will be derived from emerging economies, with new aircraft capabilities opening up new markets on the path to market liberalisation, or open skies, said Freitas, adding that strong replacement demand would be sustained.

Boeing predicts continued long-term growth for the global economy’s gross domestic product, at 2.8 percent over the next 20 years, and the number of airline passengers would grow 4 per cent, while passenger traffic measured by revenue passenger kilometres (RPKs) would rise 4.7 percent and cargo traffic 4.2 percent

Globally, airlines will need 41,030 new aircraft valued at US$6.1 trillion between 2017 and 2036, with single-aisle models accounting for 29,530, small passenger widebody aircraft 5,050, medium/large widebody 3,160, regional jets 2,370 and freighters 920.

Freitas was bullish on Southeast Asia aviation market trends. He said that the market penetration of low-cost carriers would remain robust in the near to medium term. Liberalization in intra-regional traffic and open skies with china would contribute to grow. And there are new growth opportunities via the low-cost, long-haul business model. However, Southeast Asian governments need to invest more in infrastructure to accommodate future growth, Freitas said.

The annual growth rate in Southeast Asian traffic over the next 20 years is expected to be 7.2 percent, compared to 6.3 percent for China and 8.5 percent for South Asia 8.5 per cent. An expanding middle class is opening up the access to passenger services and driving the growth in air traffic across the region.

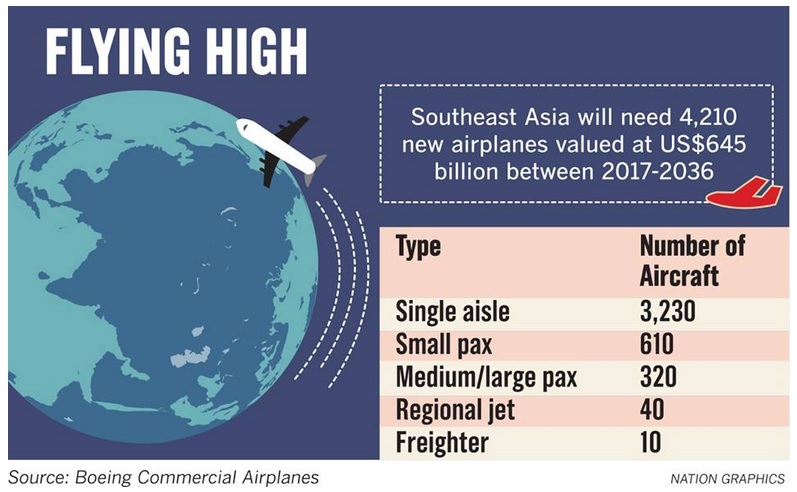

Southeast Asia will need 4,210 new aircraft valued at US$645 billion over the next 20 years. Single-aisle models would account for 3,230, small airplanes 610, medium and large models 320, regional jets 40 and freighters 10.The business model for Southeast Asian airlines has shifted. In 2016, low-cost carrier accounted for 38 per cent of the market. Boeing said this share would rise to 49 per cent in 2026 and 52 per cent in 2036.

Low cost airlines will continue to drive demand for single-aisle aircraft in Southeast Asia, the US-based aircraft giant said .

Boeing said it design aircraft to meet demand and its most popular models are in the Boeing 787 Dreamliner family.

As of October 17, Boeing received 1,283 orders from 70 customers. Total deliveries reached 606, with 347 deliveries of the Boeing 787-8 and 259 for the 787-9, the company said. THAI has leased six of the 787-8 models and two of the |787-9 models from AerCap, an aircraft leasing company.

Usanee SangsIngkeo, THAI acting president, said that the increase in air passengers in Southeast Asia and from China presents greater opportunities for THAI.

The company will focus on regional flights, she said, and had already increased such services, while conceding that budget airlines have been luring away THAI customers.

Rising oil prides also posed a challenge for airlines, in addition to the fierce competition from budget airlines, said Usanee, who was also visiting Boeing in Seattle.