PSEi goes for, then retreats from 8,600

The stock barometer yesterday flirted with the 8,600 level, setting a new intra-day peak, before succumbing to profit-taking.

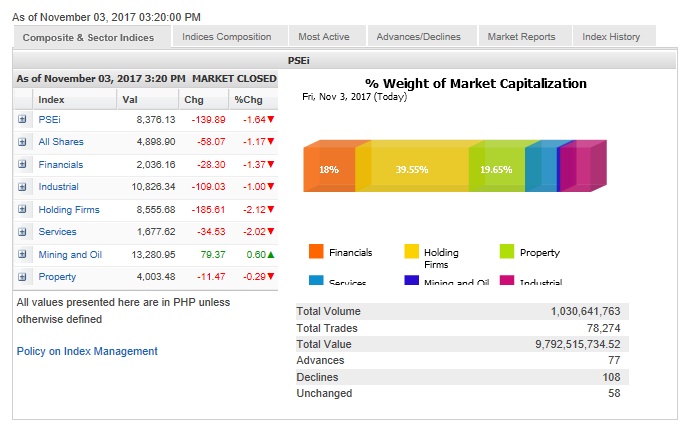

The main-share Philippine Stock Exchange index (PSEi) pulled back by 139.89 points or 1.64 percent to close at 8,376.13.

The PSEi hit a new intra-day high of 8,605.15 in afternoon trade before closing at the day’s low.

The rally to a new high was brought about by expectations that the incoming US Federal Reserve chief would keep an accommodative monetary policy.

“The incoming Fed chair is perceived to be dovish,” Eagle Equities president Joseph Roxas said.

US President Trump yesterday announced Federal Reserve Governor Jerome Powell would be the new head of the US central bank, denying current chief Janet Yellen a second term.

Roxas expects the PSEi would now enter a consolidation phase between a low of 8,200 and a high of 8,600.

The day’s decline was led by the holding firm and services counters, which both fell by over 2 percent. The financial and industrial sectors, on the other hand, both slipped by over 1 percent. The property counter also declined.

Only the mining/oil counter eked out modest gains for the day.

Total value turnover for the day amounted to P9.79 billion. There were 108 decliners that edged out 77 advancers, while 58 stocks were unchanged.

BPI led the PSEi lower, falling by 4.16 percent. JG Summit and PLDT both fell by over 3 percent while Ayala Corp. slipped by 2.66 percent.

SM Investments, Megaworld, Jollibee and Puregold all declined by over 1 percent while URC, SM Prime and Meralco also faltered.

On the other hand, GT Capital, Metrobank and AGI firmed up.

Outside of the PSEi, notable gainers included MacroAsia, which surged by 7.29 percent. Bloomberry also added 2.38 percent.

Elsewhere in the region, trading sentiment was mixed amid reports of a new US tax cut plan and ahead of the US jobs data.