The local stock barometer ended past the 8,500 mark for the first time in history on Thursday as investors welcomed an upbeat US economic assessment by the US Federal Reserve.

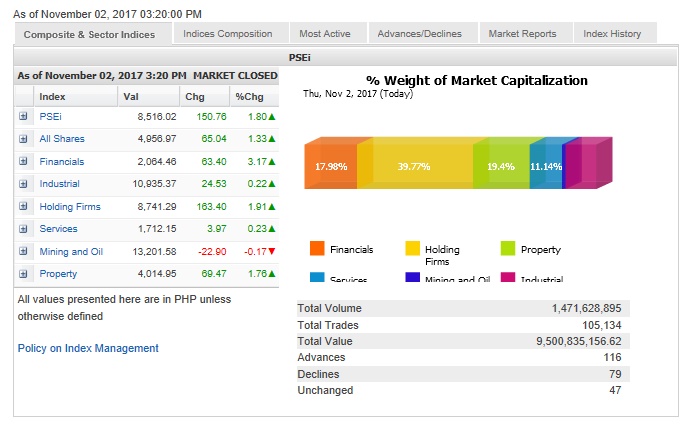

Resuming trading after a two-day midweek holiday break, the Philippine Stock Exchange index (PSEi) racked up 150.76 points or 1.8 percent to its best-ever finish of 8,516.02.

The PSEi traded between a low of 8,321.65 to a high of 8,543.80.

“Philippine markers traded into new territories once again as it made up for lost time with regional markets closing higher during our two-day holiday. Economic data from several days was rather positive, which helped boost sentiment,” said Luis Gerardo Limlingan, managing director at local stock brokerage Regina Capital Development.

The US Fed maintained the funds rate target range at 1 to 1.25 percent during its November meeting, which was widely expected. What was surprising, however, was that the US economy was assessed a “solid rate,” Limlingan noted.

“This return to a ‘solid’ pace of growth—last referenced in the January 2015 statement—underscores the committee’s more positive view on real activity, following softness in parts of the economy over the last two years,” Limlingan said.

The local rally was led by the financial counter, which surged by 3.17 percent, while the holding firm and property counters both rose by over 1 percent.

The industrial and services counters also firmed up.

Only the mining/oil counter slipped for the day.

Value turnover amounted to P9.5 billion. Net foreign buying amounted to P758.47 million.

There were 116 advancers that edged out 79 decliners, while 47 stocks were unchanged.

The PSEi was led higher by Megaworld, which surged by 6.94 percent, while Ayala Corp.—the day’s most actively traded company—gained 5.72 percent.

BDO racked up 4.73 percent, while Metrobank added 3.58 percent.

SM Investments rose by 2.62 percent while Ayala Land, BPI, GT Capital, SM Prime and Puregold all gained over 1 percent.

Outside of the PSEi, notable gainers included Bloomberry (+2.44 percent) and Global Ferronickel (+8.86 percent). Cemex, meanwhile, declined by 1.75 percent.