PH stock index sets new record, breaks through 8,500 barrier

The local stock barometer posted a new all-time high on Tuesday, piercing the 8,500 mark in intra-day trade, ahead of the third quarter corporate earnings reporting season.

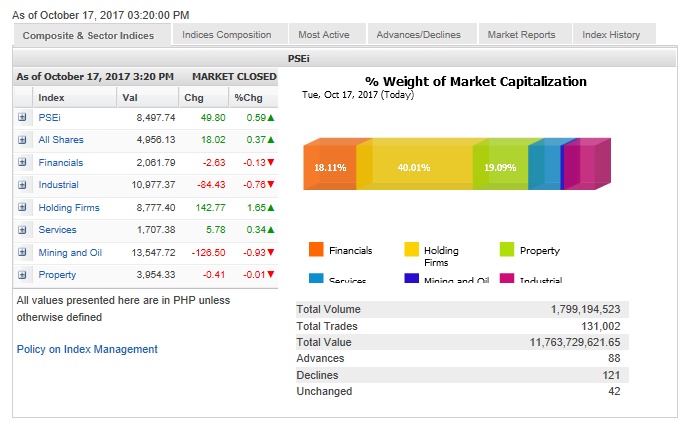

Resuming trading after a long weekend break, the main-share Philippine Stock Exchange index added 49.8 points or 0.59 percent to its best-ever finish of 8,497.74 on selective buying of large cap stocks.

The local stock barometer also breached the 8,500 mark for the first time in intra-day trade, scaling a new peak of 8,586.73 before paring gains at the close.

“Philippine markets set a new record once more, along with major US indexes setting the latest in a string of records, as investors looked ahead to key corporate earnings reports that could set the tone for trading and determine whether the lofty levels of the equity market are justified,” said Luis Gerardo Limlingan, managing director at local stock brokerage Regina Capital Development.

The stock market was closed on Monday as the government suspended work at government offices due to a transport strike.

The PSEi was led higher by holding firms, which added 1.65 percent, while the services counter firmed up by 0.34 percent.

On the other hand, the financial, industrial, mining/oil and property counters slipped.

Value turnover for the day amounted to P11.76 billion. Net foreign buying for the day stood at P498.43 million.

Despite the PSEi’s surge to record highs, market breadth was negative.

There were 121 decliners that edged out 88 advancers while 42 stocks were unchanged.

Investors accumulated shares of SM Prime, SM Investments, GT Capital and Security Bank, which all gained over 2 percent, while Ayala Corp., Metrobank and PLDT all added over 1 percent.

Shares of BDO, Megaworld, Globe and Metro Pacific also contributed to the day’s gains.

Notable gainers outside the PSEi roster included aviation support provider Macroasia, which surged by 4.77 percent, and gaming firm Bloomberry, advanced by 1.94 percent despite some concerns aired on its development of a new casino in Quezon City.

On the other hand, investors sold down shares of URC, which fell by 2.01 percent. ALI, BPI and Semirara all slipped by over 1 percent.