The local stock market yesterday reached a new high as investors deployed ample liquidity to buy property and banking stocks that track economic cycles.

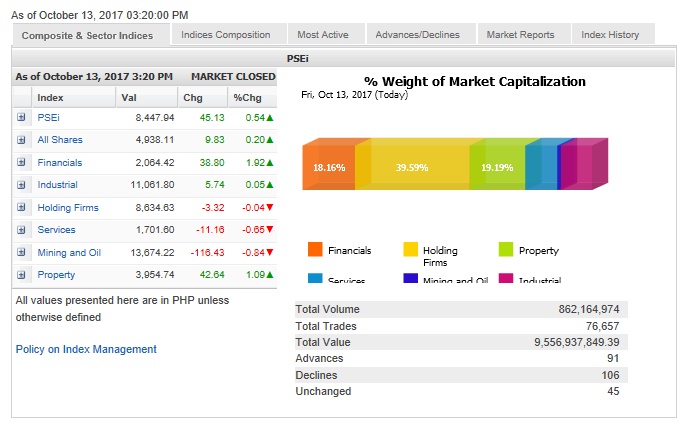

The main-share Philippine Stock Exchange index (PSEi) gained 45.13 points or 0.54 percent to a new record finish of 8,447.94. This was on the back of selective buying of large-cap stocks.

The main index closed at the day’s peak, which likewise set a new intraday high record.

Joseph Roxas, president of local stockbrokerage Eagle Equities, said liquidity from the recent tender offer of geothermal firm Energy Development Corp. was still driving the market higher as investors sought to redeploy proceeds.

“It was another fantastic rally. Market momentum is still strong. It’s really difficult to stop a train full of money,” said Astro del Castillo, managing director at fund management firm First Grade Finance.

Reports of the Bangko Sentral ng Pilipinas’ sanguine view on foreign direct investments for this year, possible increase in revenues of the Bureau of Customs and the government’s roadshow in the US likewise gave additional confidence to investors, Del Castillo said.

“Value turnover is much bigger today as well. It seems like the index could test the 8,500 level. However, profit-taking could ensue before we break the next barrier,” he added.

Foreign investors were net buyers in the market amounting to P651.18 million.

The day’s upswing was led by the pro-cyclical property and financial counters, which respectively gained by 1.09 percent and 1.92 percent. The industrial counter slightly rose.

On the other hand, the holding firm, services and mining/oil counters slipped.

Total value turnover for the day amounted to P9.56 billion.

Despite the PSEi’s record performance, market breadth was negative. There were 106 decliners that edged out 91 advancers while 45 stocks were unchanged.

Banking blue chips BDO and Security Bank led the main index higher, both rising by more than 3 percent, while Metrobank added over 2 percent. Property giants SM Prime and Ayala Land both rose more than 1 percent alongside conglomerates SM Investments, Metro Pacific and GT Capital.