The local stock barometer yesterday closed past the 8,400 mark for the first time as investors cheered the less hawkish stance of the US Federal Reserve.

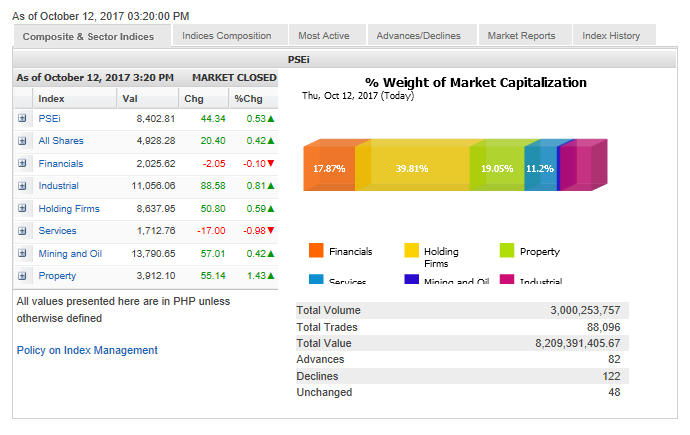

The Philippine Stock Exchange index gained 44.34 points or 0.53 percent to close at a new all-time high of 8,402.81, tracking upbeat global markets.

Selective buying of large cap stocks led the PSEi higher. On the other hand, market breadth was negative as there were 122 decliners that edged out 82 advancers while 82 stocks were unchanged.

The gains were led by the interest rate rate-sensitive property counter, which rose by 1.43 percent. The industrial, holding firm and mining/oil counters also firmed up.

The financial and services counters slipped.

Foreign investors were net buyers amounting to P247.24 million.

“Philippine markets resumed the upward trajectory as the minutes from the FOMC (Federal Open Market Committee) meeting confirmed what was on many analysts’ mind. FOMC participants adjusted their assessment of risks for inflation to the downside,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

“Many participants thought that another rate increase this year would likely be warranted if the medium term outlook remained broadly unchanged. Accordingly, we continue to place the subjective odds of a December hike at 80 percent,” Limlingan said.

Value turnover for the day was P8.21 billion.

SM Prime and URC led the PSEi higher, both rising by more than 3 percent, while Ayala Corp. and Meralco added over 2 percent.

SM Investments advanced by 1.5 percent while Ayala Land, Jollibee and Megaworld also contributed to the day’s gains.

Outside the PSEi, notable gainers included PXP Energy and leading convenience store operator Philippine Seven, which added 2.35 percent.

Meanwhile, Puregold fell by 2 percent while BPI and PLDT lost over 1 percent.

BDO, MPI, ICTSI and Semirara all slipped.