The rat race with no finish line

With a gross domestic product of 6.5 percent in the second quarter, a growth that most Western countries can only dream about, the Philippines has plenty of reasons to be optimistic. And foreign companies such as Home Credit, which has offices in nine other countries around the world, have plenty of reasons to want to stay and invest here.

A booming economy, brisk consumption across social classes and a sizeable young working population are just some of the reasons to do business in this part of the world. And with economic growth comes exciting opportunities, even for ordinary people.

Unfortunately, not everyone gets this chance.

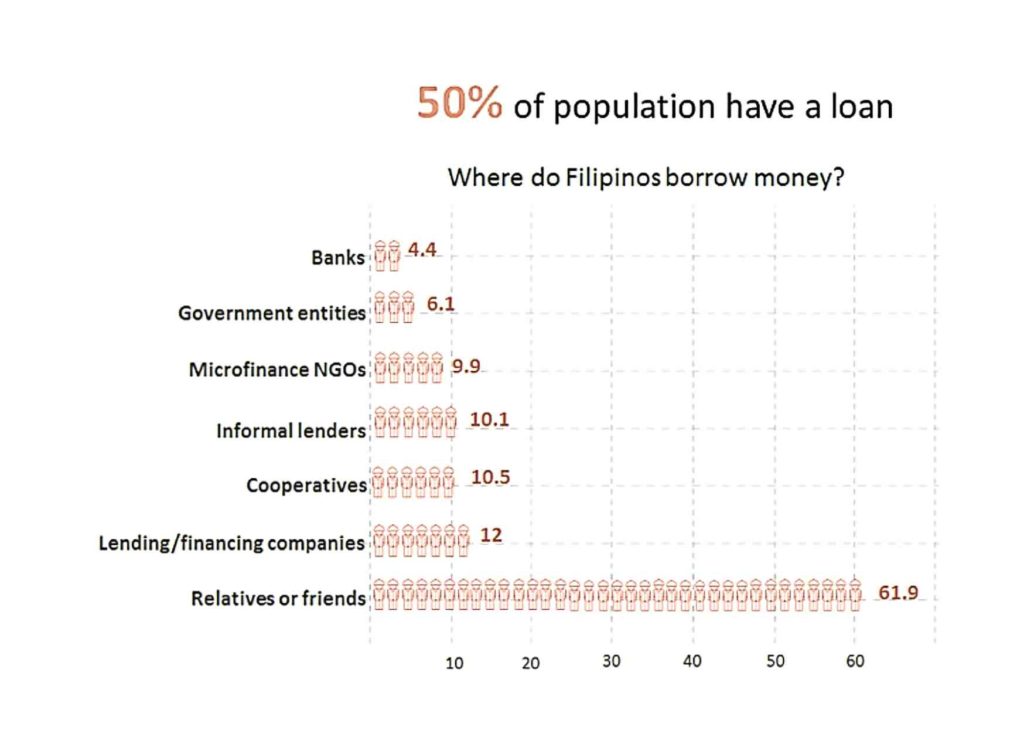

Financial inclusion remains a significant roadblock here, with the Bangko Sentral ng Pilipinas (BSP) stating that 86 percent of Filipino households are unbanked, and 60 percent of Filipino adults unable to set aside money for savings.

We’ve encountered some of them first hand. Out of Home Credit Philippines’ (HCPH) 1.4 million customers, around 70 percent do not have bank accounts and around 80 percent are first-time borrowers who had never been approved of or experienced getting a loan, credit card or other financial tool.

Article continues after this advertisementFor these individuals, financial exclusion is virtually guaranteed: They can’t get a loan because they don’t have a credit history, and they can’t get a credit history because they have never been approved for a loan. It’s a rat race with no finish line.

Article continues after this advertisementThe good news is that there are concrete steps already being taken to bridge these gaps. The BSP is among those leading the pack thanks to their National Strategy for Financial Inclusion, which calls for active participation from various sectors.

For more people to be financially included, there should be more institutions willing to grant loans and provide access to credit cards or other financial tools. This is easier said than done, of course. But it can be done, and we can be a testament to that.

Home Credit has been successful in running a business model that is centered on responsible lending—facilitated by a fast approval process with minimal requirements—to the mass market, including first-time borrowers with little or no credit history. This business model is, by design, geared towards attracting and addressing the needs of the underserved.

While finance companies do not necessarily have to follow this model to be inclusive, I believe we can share common keys or principles to make our products and services more accessible to more people.

Technology and data are two of these keys, and as a fintech company, these are our go-to drivers for financial inclusion.

We gather and analyze data from a wide variety of sources, which helps us approve more loans for more people at faster speeds. And we have a sophisticated risk management system that can predict the chance of loan repayment, thus allowing for a highly accurate assessment of loan applications.

The information that we gather is crucial not just in helping our customers get approved for a loan, but also in creating opportunities for more access to financial services.

This is achieved in cooperation with the government. HCPH was one of the first companies to share its credit database to the Credit Information Corporation (CIC) in compliance with Republic Act 9510, or the Credit Info Systems Act. We have also conducted joint activities with CIC to raise awareness on the importance of having a good credit history.

That is why financial literacy is our number one advocacy, and we have a program called “Juan Two Three!” that brings Home Credit volunteers to different communities to share basic financial literacy concepts. We have done events in collaboration with the Department of Education, and we have partnered with the Department of Social Welfare and Development (DSWD) to bring together “Juan Two Three!” and its own “Pantawid Pamilyang Pilipino Program” in promoting sustainable development among the underserved.

We are certainly not the first company to be doing these types of initiatives, and we hope we’re not the last. As more companies and agencies band together to include more people in the financial system, education becomes more crucial than ever in making sure that the inclusion created is a sustainable and truly beneficial one.

And that would give companies like us even more reason to stay.—CONTRIBUTED