The local stock barometer soared to new heights yesterday as upbeat trading in Wall Street emboldened yield-seeking local investors.

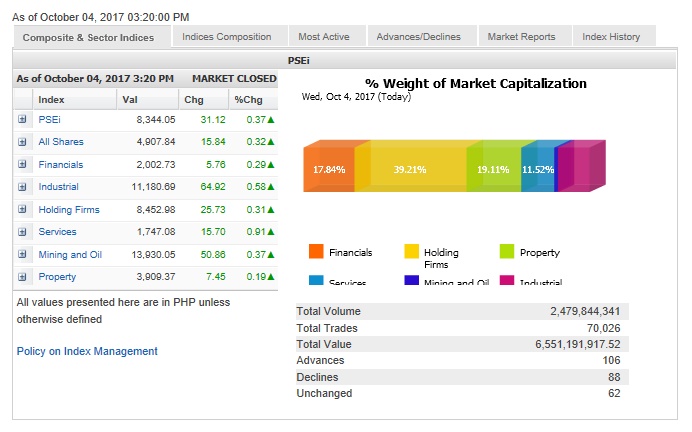

The main-share Philippine Stock Exchange index (PSEi) gained 31.12 points or 0.37 percent to close at 8,344.05, tracking mostly higher US and regional markets.

The index also hit a new intra-day peak of 8,377.79.

“Record close in Wall Street and renewed optimism in global economic growth powered our local bulls in the market. Investors continue to ignore valuations and other concerns. Market players chose to play deaf on reports of higher price to earning (P/E) ratios, creeping inflation and political noise,” said Astro del Castillo, managing director at local fund management firm First Grade Finance.

“It’s really difficult to ignore the strength of the market nowadays. The bandwagon could leave you behind,” he said.

However, Del Castillo said the bulls might take a break in the coming days “to digest the risks that are still evident in the horizon.”

All counters firmed up. Value turnover, however, was thin at P6.55 billion.

Local investors, some of whom were awash with cash from the recent tender offer on EDC, fueled the day’s rally. On the other hand, foreign investors were net sellers amounting to P426.39 million.

There were 88 advancers that edged out 62 decliners while 62 stocks were unchanged.

The PSEi was led higher by BDO and PLDT, which both rose by more than 2 percent, while Ayala Corp. added over 1 percent.

SM Investments, Ayala Land, DMCI, Jollibee, AGI, BPI, GT Capital and Metro Pacific also gained.

Outside of the PSEi, notable gainers included Bloomberry (+3.81 percent) and PXP (+4.2 percent).

On the other hand, SM Prime, Megaworld and RRHI slightly declined.

Gaming operator Melco fell by 2.7 percent. FNI likewise fell by 1.06 percent.