PH stocks close at a new record high on upbeat global, regional markets

The local stock barometer finished beyond 8,300 for the first time yesterday as cash-rich domestic investors gobbled up local equities, taking their cue from upbeat US economic data to sustain the market’s breakout to new highs.

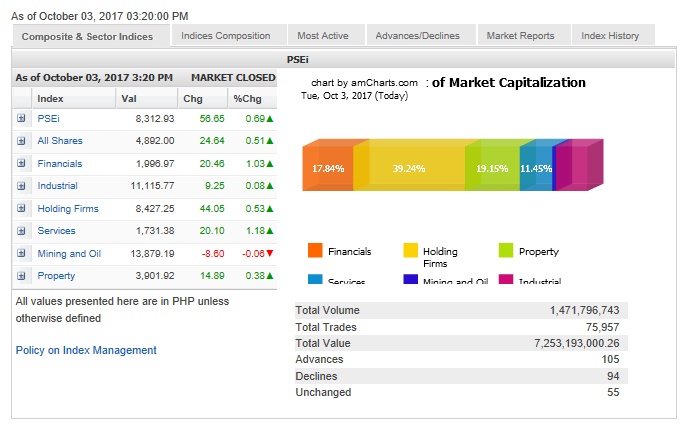

The main-share Philippine Stock Exchange index racked up 55.65 points or 0.69 percent to close at a new all-time high of 8,312.93, tracking mostly higher regional markets.

Except for the mining/oil counter, all other counters firmed up led by the financial and services sub-indices, which both gained over 1 percent.

Eagle Equities president Joseph Roxas said the PSEi’s rally was driven by a surge in liquidity as the recently concluded tender offer for geothermal power producer EDC brought more money into investors’ pockets.

He estimated that the EDC tender offer likely boosted domestic investors’ liquidity by P20 billion to P30 billion.

Including those received by foreign investors, he said the EDC equity deal had freed up around P50 billion.

Roxas said PSEi’s next target for the immediate term would be 8,400.

VC Securities president Wilhemino Agregado said in a press briefing on the launch of his firm’s trading platform VC Trade yesterday that investors were upbeat on prospects for the stock market.

The government’s plan to liberalize foreign ownership restrictions in highly regulated industries, he said, would further bring good tidings.

Agregado said the PSEi would likely end at around 8,500 this year, adding that many investors were now positioning for the local stock barometer to reach 10,000 by next year.

“Philippine stocks broke new ground once more and US stock benchmarks traded in record territory…as equities resumed a steady run-up that could set the tone for the final three months of 2017. The moves for stocks occurred amid an upbeat tone on Wall Street despite a mass shooting event in Las Vegas that is being described as the worst in US history,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

Domestic investors powered the day’s rise, taking up the stocks unloaded by foreign investors. There was P689.83 million in net foreign selling for the day.

Value turnover amounted to P7.25 billion. There were 105 advancers that outnumbered 84 decliners while 55 stocks were unchanged.

Retailers RRHI and Puregold led the PSEi’s rally, respectively rising by 5 percent and 4.57 percent. RRHI just recently joined the PSEi.

AGI and Security Bank both rose by over 2 percent while BDO and PLDT added over 1 percent.

Ayala Land, SM Investments, Metrobank, Megaworld, BPI, Ayala Corp. and MPI also contributed gains.

Outside of the PSEi, one notable gainer was PXP, which surged by 13.75 percent.

Shares of this company have been rising in recent weeks on speculation of an oil exploration deal with China.

On the other hand, GT Capital, Jollibee and URC all slipped.