‘Train’ offers hope to housing sector

The Senate version of the tax reform package offers hope to real estate industry as it retained exemptions for socialized housing.

Not all hope is lost.

The Senate version of the Tax Reform for Acceleration and Inclusion (Train) or Senate Bill 1592, offers a certain relief for the real estate industry as it proposed to retain exemptions for socialized housing.

SB 1592, which Sen. Sonny Angara sponsored on the floor Wednesday night, stated that these transactions, among those identified in the bill, shall continue to be exempt from the value added tax (VAT):

Sale of real properties not primarily held for sale to customers or for lease in the ordinary course of trade or business;

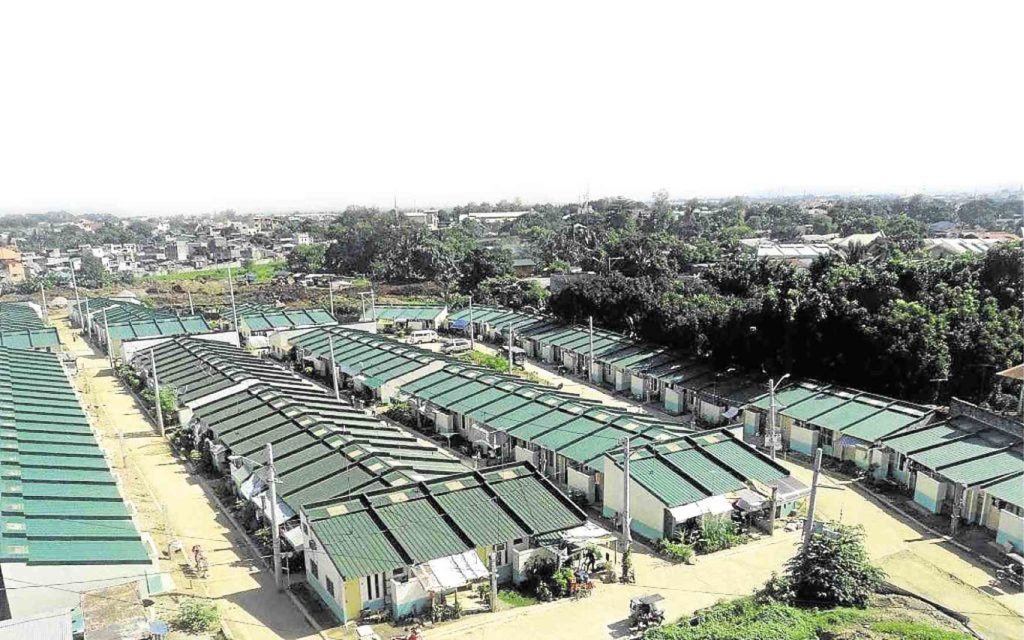

Sale of real property utilized for socialized housing as defined by Republic Act No. 7279, otherwise known as the Urban Development and Housing Act of 1992;

Sale of house and lot, and other residential dwellings located outside Metro Manila with selling price of not more than P2 million: provided, that not later January 31, 2021 and every three years thereafter, the amounts herein stated shall be adjusted to their present values using the Consumer Price Index, as published by the Philippine Statistics Authority (PSA); and

Lease of a residential unit with a monthly rental not exceeding P12,800: provided, that not later than January 31, 2021 and every three years thereafter, the amount herein statewd shall be adjusted to its present value using the Consumer Price Index, as published by the Philippine Statistics Authority

At present, the government grants VAT exemptions to all house and lot packages that cost up to P3.199 million per unit.

Potential slowdown

The Senate version of Train was in contrast to the House version (House Bill 5636), which sought to remove tax exemptions for the said segment.

HB 5636, which was approved by the Lower House on May 31, seeks to improve Filipinos’ disposable income by reducing personal income tax for majority of its citizens.

Industry players fear that the lifting of tax exemptions on socialized housing will slow down the residential market.

However, it also sought to increase revenue collection by removing certain VAT exemptions including the sale of low cost housing; sale of residential lot valued at P1.919 million and sale of other residential dwellings valued at P3.199 million; and lease of residential units not exceeding P12,800 per month, Colliers International Philippines reported in July.

The sale of socialized housing is also expected to be removed from VAT exemption upon the establishment of a housing voucher system.

Colliers had warned that the the government’s tax reform plan, given its proposed provisions on housing related transactions, will “potentially slow down the residential market.”

“If the House Bill is passed into law, selling prices of low-cost housing stand to add as much as P384,000 due to VAT. Colliers believes that the increase is quite significant especially for starting families or new professionals,” said Dinbo Macaranas, Colliers’ senior manager for research.

Colliers pointed out that over 10,700 condominium units were taken up in the first quarter of 2017 in Metro Manila, up by 29 percent from the same period last year. Interestingly, about 40 percent of the take-up accounts for low cost and socialized housing groups. Thus, the removal of the VAT-exemptions will potentially slowdown the take-up, it explained.

Industry appeal

Even industry organizations had been appealing for the retention of tax exemptions for the socialized housing segment.

In May, prior to the approval of House version of the comprehensive tax reform package, the Chamber of Real Estate and Builders’ Associations Inc. similarly warned that the plan to lift VAT exemptions “will gravely affect government efforts to address the perennial and ever-increasing housing backlog.”

Citing the Housing and Urban Development Coordinating Council (HUDCC), Creba noted that the backlog has reached 5.7 million units as of 2016.

Creba national chairman Noel M. Cariño even claimed that despite existing tax exemptions, housing remains to be one of the most, if not the most “heavily-taxed, highly-regulated” industry in the country.

Overhauling the system

The comprehensive tax reform package is one of the measures being pushed by the Duterte administration, as it wanted to overhaul the country’s outdated tax system which has remained unchanged for almost two decades and unadjusted to inflation.

The provisions in Train, for both the House and Senate versions, have noble, noteworthy intentions: improving the purchasing power of Filipinos through the reduction of the personal income tax rates.

However, these proposed bills also seek to widen the VAT base through the reduction of tax exemptions, which will likely impact consumers as well through increased prices of fuel, vehicles, and sugar sweetened beverages, among others.

From the perspective of players in the real estate industry, it is hoped that the proposed comprehensive tax reform package will not diminish Filipinos’ capacity to own a decent home, and will not derail existing efforts to curb the worsening housing backlog, estimated to have ballooned to roughly 5.7 million units.

It is likewise hoped that SB 1592, which is expected to generate an additional P134 billion for the national coffers, will really “help ensure the financial sustainability of the government’s ambitious agenda to sustain the country’s growth momentum and accelerate poverty reduction via a massive spending on infrastructure, human capital and social protection for the poor and vulnerable sectors” as the government had intended to achieve.