The local stock barometer retreated from all-time highs on Tuesday as investors turned cautious ahead of the upcoming US Federal Reserve monetary setting.

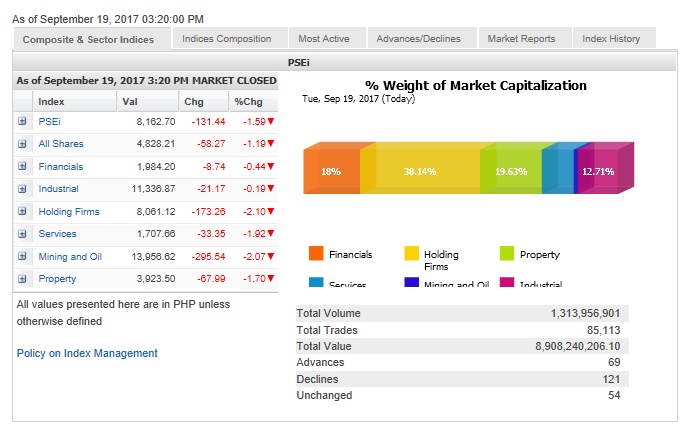

The main-share Philippine Stock Exchange index (PSEi) pulled back by 131.44 points or 1.59 percent to close at 8,162.70, while regional markets were mixed ahead of the Sept. 19-20 meetings of the US Federal Open Market Committee.

Even as it was the last day of the “ghost month”—the Lunar month where many Oriental investors turn cautious—investors pocked gains after the PSEi probed new highs for three straight days.

All counters ended in the red, weighed down most by the holding firm and mining/oil counters which both tumbled by over 2 percent. The services and property sub-indices slipped by over 1 percent.

Total value turnover for the day amounted to P8.91 billion. There was net foreign of P272 million.

There were 121 decliners that edged out 69 advancers while 54 stocks were unchanged.

The PSEi was weighed down most by Megaworld, which fell by 5.11 percent, while GT Capital slid by 4.09 percent.

Ayala Corp. tumbled by 3.81 percent while SM Investments, Ayala Land, PLDT and ICTSI all declined by over 2 percent.

URC and SM Prime both slipped by over 1 percent while BDO, Jollibee, Metrobank and Metro Pacific all slipped.

Aside from the two-day US Fed meeting, a key domestic event this week is the Bangko Sentral ng Pilipinas’ monetary setting on Thursday.