Benchmarking Asean farm productivity and growth

Productivity is key to inclusive growth. Studies show that the Philippines lags behind its Asean neighbors in farm productivity.

In this article, two measures are compared across key Asean countries: total factor productivity, and specific crop land productivity.

The comparisons do not discuss the factors behind the numbers.

Total factor productivity (TFP) is the most informative measure of agricultural productivity.

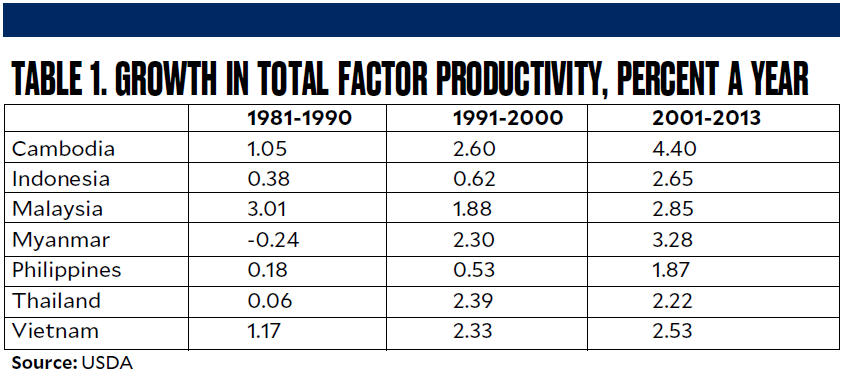

Comparing TFP over the past 28 years, the Philippines trailed behind its Asean peers.

It ranked 5th among seven countries in the 1980s, last in the 1990s and 2000s.

Table 1. Growth in Total Factor productivity, percent a year

Crop yield comparison

Crop yield, on the other hand, measures the farm output per unit of area, i.e., tons per hectare (ha). Five Asean countries were covered: Indonesia, Malaysia, Philippines, Thailand and Vietnam.

During 2012-2014, among nine key crops, Indonesia had five in the top two high yielders compared to four each for Malaysia, Vietnam and Thailand.

The Philippines had only one: Sadly, it dominated the lowest yield ranks.

Table 2. Comparison average yield, 2012-2014 average

Yield increases since 1986

Which Asean country achieved the highest absolute yield increase since 1986? The leaders were: Vietnam with six crops in the top 2, Thailand five, and Indonesia and Malaysia, three each. The Philippines had only one (pineapple).

Table 3. Comparison of absolute average yield increase from 1986-1988 to 2012-2014

Rice

Vietnam and Indonesia were ahead in average rice yields in 2012-2014. The Philippines was in the middle, ahead of Malaysia (a rice importer) and Thailand (a major rice exporter).

Maize (corn)

Malaysia, a small producer with only 9,700 ha, had the highest yield and growth. The Philippines had the lowest yield among the five countries and the fourth slowest in yield growth.

Coconut

Vietnam, Malaysia and Indonesia had the highest yield. By contrast, the Philippines, the country with the largest coconut area, had the lowest.

Sugarcane

Malaysia and Thailand had the highest yields. The Philippines had the lowest yield and one of the two countries with yield decline.

Banana

The Philippines belongs to the world’s top banana exporters. Surprisingly, its average yield was only third highest. This is to be expected. While Cavendish banana averages over 40 tons/ha, those of other varieties—lakatan, latundan and saba—are much lower.

Cassava

Indonesia, Thailand and Malaysia were the high yielders. The Philippines was last. Thailand and Vietnam are world players in cassava chips and starch exports.

Vietnam and Indonesia posted the fastest yield increases. The Philippines was last.

Coffee

Vietnam and Malaysia had the highest yields. The former is the world’s largest robusta exporter; the latter is a small niche producer with only 3,700 ha. The Philippines recorded the lowest yield.

Pineapple

Indonesia had an incredibly high yield (with only 16,000 ha), distantly followed by the Philippines (61,000 ha). Both posted the highest yield growth.

Rubber

Four Asean countries namely, Thailand, Indonesia, Vietnam and Malaysia, are among the world’s top rubber producers. Vietnam and Thailand were far advanced in yields. The Philippines had the lowest.

Conclusions

The analysis shows that the Philippine farm yields were mostly behind those of its Asean counterparts. It is also a laggard in boosting yields since 1986.

The year 1986 is a watershed. There was the Edsa people power revolution and the start of the long-drawn CARP, the latter to distribute lands anchored on productive, small farms. In Indonesia, Malaysia and Thailand, small farms co-exist with large tree-crops estates.

The Philippines had the highest national poverty (21.6 percent) in 2015 and the highest rural poverty (30 percent) among peers.

Is high rural poverty directly correlated with low productivity? Are strategies, structures and institutions key levers? An international expert suggests an integrated program that has direct impact on crop productivity across specific value chain corridors.

Is execution our weakness?

It is food for thought for the Duterte administration.