E-commerce fast taking over traditional retailers’ territory

In the world of fast-moving consumer goods like soap and shampoo, a “new order” is on the rise: Traditional retailers may soon be overtaken by e-commerce and discounters because of their promise of convenience and affordability.

This is the main finding of “Winning Omnichannel,” the annual report of global research firm Kantar Worldpanel on real shopping behavior and the retail choices of more than three billion people in 28 countries, which also observed the interaction between all channels—from traditional to modern trade and e-commerce—over the past three years.

The report also predicts changes facing the retail landscape over the next three years, and explores how these might impact FMCG sales in the future.

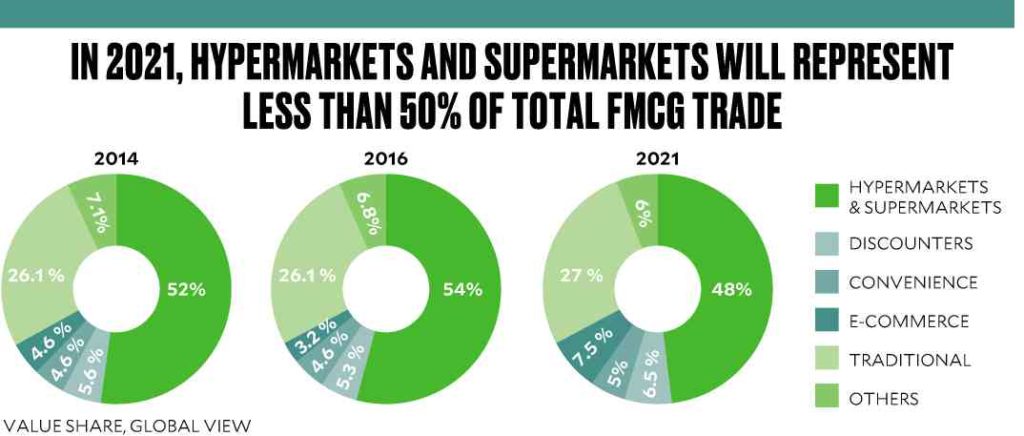

One such forecast, based on the finding that the market share of supermarkets and hypermarkets is shrinking, is that by 2021, the global FMCG spend in these establishments will be reduced to only 48 percent, from 52 percent in 2016.

The report adds that a comparison of 2015 and 2016 data shows that hypermarket and supermarket FMCG value sales grew by only 0.7 percent, while online spend grew by 26 percent, and discounters by 5.1 percent.

Article continues after this advertisement“[Hypermarkets and supermarkets] are still growing, but a sluggish pace,” the report reads. “It has seen some success in some developing regions of Latin America; however, it is struggling against discounters in the United Kingdom, and Spain, Peru, where traditional trade still dominates, and in South Korea where e-commerce is fast becoming the dominant channel.”

Article continues after this advertisementThe Philippines, in particular, is one market wherein value share (percentage of FMCG purchases versus total FMCG purchases of hypermarkets and supermarkets is still fast growing at 6 percent.

Traditional trade formats (i.e. door-to-door, cash and carry, sari-sari stores) are also still performing well here, at 52 percent of value share in 2016, representing a 3-percent growth from the previous year.

As for e-commerce, it is in advanced markets where the share of online grocery shopping continues to rise, the report notes, such as South Korea (41 percent), China (53 percent), and Taiwan (36 percent).

Global value share is expected to be at 7.5 percent in 2021, the report states, from 4.6 percent in 2016.

Discounters come in as the second-fastest growing channel, which is expected to have a global value share of 6.5 percent in 2021, from 5.6 percent in 2016. The growth is most evident in Colombia, where e-commerce value share grew from 7 percent in 2015 to 124 percent in 2016, the year when around 600 such stores were opened.

“Channels which traditionally dominated the field are in steady decline worldwide. Step forward the new order: e-commerce and discounters, cannibalizing the big retailers with their promise of convenience and lower prices,” says Kantar Worldpanel global shopper and retail director Stephanie Roger. “Technology is fast-changing the way people shop, and with e-commerce and discounters set to continue their march at the expense of large-format retailers, there is an urgent need for retail reconfiguration across the world.”