The local stock barometer slightly gained yesterday, staying afloat 8,000, while tracking firmer US stocks overnight.

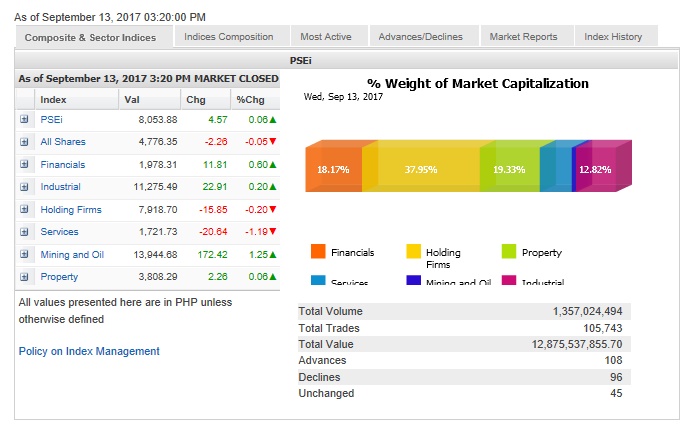

The main-share Philippine Stock Exchange index (PSEi) added 4.57 points or 0.06 percent to close at 8,053.88.

“Local shares continued their ascent albeit minimal as US stocks rose to all-time highs on Tuesday as financials received a boost from rising yields. However, price action was tempered somewhat by selling pressure in tech (sector),” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

“Fears over Hurricane ‘Irma’ and geopolitical tensions in Korea eased. Wall Street also digested comments from US Treasury Secretary Steven Mnuchin on tax reform,” he added. Mnuchin said he was “hopeful” that tax reform would be accomplished by year’s end.

The day’s gains were led by the mining/oil counter, which rose by 1.25 percent. The financial, industrial and property counters also inched up.

On the other hand, the holding firm and services counters dipped.

Value turnover for the day amounted to P12.87 billion, including the P3.8 billion block sale on Bloomberry. Net foreign buying for the day amounted to P3.34 billion. There were 108 advancers that edged out 96 decliners while 45 stocks were unchanged.

GT Capital led the PSEi higher with its 3.66-percent gain, while Security Bank rose by 2.38 percent. Ayala Land, DMCI and Semirara all advanced by more than 1 percent while BDO Unibank, Metrobank, Ayala Corp. and URC also firmed up.

Outside the PSEi, notable gainers included IMI (+5.95 percent).

Meanwhile, SM Investments fell by 2.05 percent while Globe Telecom slipped by 1.24 percent. SM Prime, MPIC, AGI, ICTSI and Jollibee also declined.

Outside of the PSEi, Bloomberry fell by 7.73 percent after the company’s chair Enrique Razon Jr. sold shares at a discount to market prices.

Razon sold to institutional investors 350 million shares of Bloomberry at P10.85 each, representing 3.18 percent of his stake. The deal was priced at an 8-percent discount to the company’s volume-weighted average price on Monday.