COA flags P127-M shortfall in taxes from QC property developers

Editor’s note: This article has been updated to include SMDC’s response.

The Commission on Audit has called on the Quezon City government to require 22 real estate companies to pay correct taxes after finding a P126.586-million discrepancy between their declared gross receipts and the actual proceeds from their transactions.

In its 2016 annual audit report, state auditors said the city treasurer and business permit and licensing officer should mete out penalties “against the owners/proprietors” for underdeclaring their gross receipts for the purpose of annual business tax assessments.

The information technology and development officer, meanwhile, should design an automated system to capture the transactions of real estate businesses to provide a ready basis in the billing preparation.

The discrepancies were unearthed from the deeds of absolute sale covering the companies’ transactions in support of the payment of separate property transfer taxes.

The companies’ failure to declare these transactions for the purposes of paying annual business taxes caused the city to lose millions of pesos in revenue.

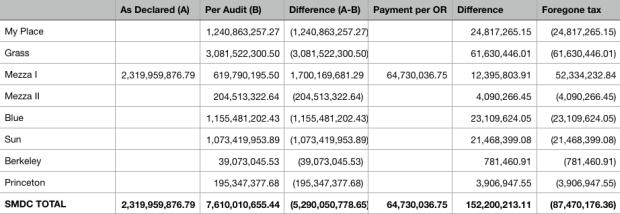

Eight of the companies fall under the Sy-led SM Development Corp.:

- MyPlace Condominium in South Triangle

- Grass Residences at North EDSA

- Mezza Residences I in Sta. Mesa

- Mezza Residences II in Sta. Mesa

- Blue Residences on Katipunan

- Sun Residences at the Welcome Rotonda

- Berkeley Residences on Katipunan

- Princeton Residences in New Manila

SMDC reportedly declared P2.32 billion in gross receipts through Mezza Residences I and paid P64.73 million in business taxes – while the other SMDC units apparently did not declare any and thus did not pay the corresponding business taxes.

An audit of the official receipts for the property transfer taxes paid by the SMDC units reportedly yielded deeds of absolute sale indicating their real estate transactions that could have been assessed for P87.47 million in foregone business taxes.

“These companies showed selling transactions for real estate but did not appear to have paid Business Tax on the sale, dealing nor developing real properties. These companies have business addresses in the City,” read the report.

However, SMDC in a statement to INQUIRER.net said, “SMDC asserts that it has paid all prescribed local business taxes pertaining to its projects in Quezon City. Furthermore, SMDC has not received any communication regarding any variance or shortfall on its local business tax payments.”

Other major companies with substantial tax discrepancies include:

- Villar-led Vista Residences, Inc. – P11.46 million

- Ayala-owned Alveo Land Corp. and Avida Land Corp. – P10.42 million and P863,697.15

- Lopez-owned Rockwell Land Corp. – P10.14 million

- Tan-led Fil-Estate Properties, Inc. – P1.88 million

- L.K. Global Realty & Development Corp. – P1.26 million

COA said it was informed in April that the city treasurer’s office already sent out communications to the various developers. At the time the annual audit report was prepared, Vista requested a 30-day extension to submit documents.

Meanwhile, Con-Tech Properties, Inc. and Princess Homes Realty and Development Corp. requested a 12-month installment payment scheme for their P975,876.40 and P944,036 tax discrepancies starting April 2017.

Inconsistent tax rates

COA also observed that business tax rates were not uniformly applied on the real estate developers, casting doubt on the reliability of the system and accuracy of the tax collections.

While most developers including SMDC’s Mezza Residences I, Ayala Land Corp. and Empire East Land Holdings, Inc., were assessed within the 2-percent range, a higher tax rate of 3.04 percent and 3.549 percent were applied against Rockwell and Banff Realty & Development Corp.

The tax rates were even higher for smaller taxpayers like L.K. Global (5.373 percent), Right Price, Inc. (5.6 percent), G-Land Property & Development Corp. (6.05 percent), and First Marcel Properties, Inc. (11.72 percent).

Another observation of COA was that at least seven business establishments declared identical gross receipts for two or three years, which it found “highly improbable.”

Banff declared exactly P69,502,872.91 in gross receipts for both 2013 and 2014, while Homemark Inc. did the same for its P50,387,361.60 declarations in 2014 and 2015. L.K. Global declared P30 million in gross receipts for both 2013 and 2014, while First Marcel declared P1,444,438.85 for both 2015 and 2016.

COA suggested that the City Treasurer examine the developers’ books of accounts to determine the true amount of gross receipts and the assessment officers be made to explain the occurrence of similar declarations. /atm

Source: Commission on Audit