Stock price index ends firmer ahead of major central bank meeting

The local stock barometer firmed up for the second session in a row yesterday ahead of a long weekend break and a much-awaited central bank symposium in Jackson Hole, Wyoming.

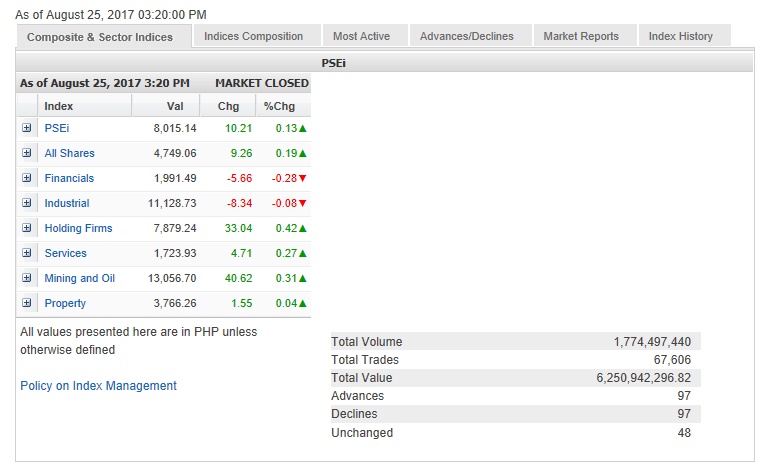

The main-share Philippine Stock Exchange index (PSEi) added 10.21 points or 0.13 percent to close at 8,015.14.

Local financial markets will be closed on Monday (Aug. 28), a non-working holiday in commemoration of “National Heroes Day.”

For this week—the first week of the so-called “ghost month”—the index ended flat compared to last week’s finish of 8,016.73.

Citi group said in a research note that ahead of comments by US Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi at the Jackson Hole symposium Friday night (Asia time)—and amid unexpected geopolitical developments and continuing political uncertainty in the US—global macro markets are mostly consolidated.

“While comments at the Jackson Hole symposium are investors’ immediate focus, over the next few weeks interest is likely to shift to the US debt ceiling issue and a potential government shutdown. President Trump’s recent comments have alerted markets about this earlier than usual. Despite it being obvious that there is limited appetite among members of Congress, especially Republicans, to stage a shutdown this fall, market concerns may not quickly dissipate even as the administration attempts to shift the agenda towards tax cuts. Unresolved, this issue is likely to continue to weigh on US yields,” Citi said.

In the meantime, Citi said the latest stream of economic data confirmed that the ongoing business cycle recovery remained intact, that the global economy was “increasingly robust” and that inflation remained low in the advanced economies.

At the local market yesterday, value turnover amounted to P6.25 billion. Market breadth was neutral: There were as many advancers as decliners (97 each).

The local market was perked up by modest gains from holding firms, services, mining/oil and property counters.

On the other hand, the financial and industrial counters slipped.

The PSEi was led higher by URC, which advanced by 1.06 percent, while Metrobank and Megaworld slightly gained.

On the other hand, the notable gainers among the day’s most actively traded stocks were non-PSEi stocks. The most actively traded company was Davao-based businessman Dennis Uy’s Phoenix Petroleum, which added 1.67 percent, while his newly listed Chelsea Logistics also gained 2.1 percent.

Gaming stock Bloomberry jumped by 3.4 percent while cement firms Cemex Holdings and Eagle Cement both surged more than 3 percent.

City of Dreams operator Melco Resorts and Nickel Asia both added over 2 percent.

On the other hand, the PSEi’s gains were tempered by the decline of ICTSI, which slipped by 1.42 percent, while BDO, BPI, Jollibee, GT Capital and DMCI also lost ground.