When two great houses decide to lay down their arms and work together, instead of plotting against each other, a lot can be accomplished.

We’re not talking about the Game of Thrones here but the country’s two largest property groups, Ayala Land Inc. and SM Prime Holdings, archrivals that have set aside their differences and formed a rare partnership to unlock values in Ortigas & Co. Ltd. Partnership (OCLP), likewise an old name in the property scene.

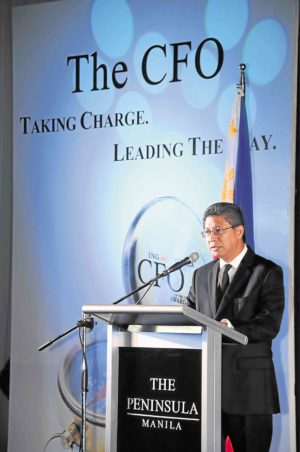

Tasked to head Ortigas & Co., which is undertaking about P210 billion worth of mixed-use real estate projects, is 57-year-old Jaime Ysmael, former chief finance officer (CFO) of Ayala Land.

Ysmael, who was ING-FINEX (Financial Executives Institute of the Philippines) “CFO of the Year” awardee in 2011, sees his new job as “challenging but exciting.”

“We’re trying to marry three cultures—the legacy culture of the Ortigas brand and Ortigas organization, SM Prime and Ayala Land,” Ysmael says in an interview with Inquirer at his new office. “The objective is to tap synergy by drawing from strengths of each and every partner, and trying to bring them together and create a culture that could hopefully blend all of the nice elements of the different cultures.”

OCLP, whose tagline is “we build great places for life,” seeks to address a slightly different niche from that addressed by either ALI or SM Prime.

A long time ago, OCLP’s founders acquired from the Augustinian friars around 4,000 hectares of land spanning the cities of San Juan and Quezon City, known in the old days as “Mandaluyon” estate. Most of these have been sold down and developed over the years, but to date, OCLP still has a lot of prime land bank in the metropolis, including reversion right to parts of Camp Crame.

One of OCLP’s crown jewels, for instance, is the 16-hectare Greenhills Shopping Center, home to tiangges or bargain retailers and start-up entrepreneurs.

Moving forward, Ysmael says Greenhills will continue to be an incubator of small businesses even as the entire estate is now being redeveloped to unlock more values out of its land bank.

Recently, the P60-billion masterplan for Greenhills was unveiled, a redevelopment agenda that includes building residential towers, doubling the leasable area for shopping and office space, a hotel, underground parking and pedestrian-friendly roads.

OCLP also plans to spend another P60 billion to develop the 10-hectare Capitol Commons, P60 billion to develop the 16-hectare Frontera Verde or the area many people know as Tiendesitas and another P30 billion for 10-hectare residential-retail complex Circulo Verde.

The company also owns several valuable parcels of land in Ortigas and over 300 hectares outside Metro Manila, mostly in the Rizal area.

The CFO as CEO

As CFO of Ayala Land, Ysmael did not just embrace the traditional role of generating financial statements promptly and accurately or taking care of the balance sheet. He believed that the CFO is also a company’s “moral compass,” one who makes sure that rules and regulations are being followed and good corporate governance practices instituted.

More and more, he said CFOs are now being given more chances to make a difference—first, by being a strategist and helping the CEO and the rest of the management team chart a plan of action and second, being part of the team that executes.

But now that the CFO is a CEO, that gives him an even greater understanding of the different components that deliver value to the company. However, assuming the CEO role also requires a change in mindset.

Ysmael embraces his new role

“It’s a much broader role to be the CEO, although as a CFO, you see that and observe, but it’s only when you become CEO that you actually get your feet wet, so to speak, and experience that new mindset. It’s definitely a broader mindset, now that you are accountable for everything and not just one aspect. You have to look at all the different aspects of operations and take a direct hand in managing these different aspects, unlike the CFO, which still has a helicopter view,” he says.

Having a CFO background also allows Ysmael to “download” the best practices he had learned over the years to the finance person. But as CEO, he is more involved in all stages of the property business—from planning, designing, construction, execution, marketing, selling and even after-sales servicing.

Furthermore, Ysmael is seen to bring to OCPL the kind of discipline that Ayala Land has practiced over the years. Unlike other property firms, Ayala Land has no foreign exchange loan exposure, which served it well when the Asian currency crisis erupted in 1997. Since then, however, he noted that the property industry as a whole had learned its lesson.

“A lot of companies were hit badly, some were saved by white knights, others went through painful reorganization and restructuring but it taught the system good lesson as well on how to manage the business from a financial standpoint. Government also learned a lot, especially the central bank.

Basically we absorbed the bitter pill as a system, which serves us well now,” he says.

From Ysmael’s point of view, the local property industry is now much more prudent, more capitalized, more disciplined, stronger in terms of balance sheet and no longer as aggressive in terms of pricing. At the same time, the macro environment has improved significantly, resulting in historically low interest rates and very long borrowing tenors. Coupled with ample liquidity in the banking system, this has buoyed the property market since 2006, he says.

Beginnings

Ysmael is the kind of executive whose professional achievements are matched by his academic success.

He graduated Summa Cum Laude from the University of the East with a Bachelor of Science in Business Administration, Major in Accounting. He also holds an M.B.A. in Finance from Wharton School and an M.A. in International Studies from the School of Arts and Sciences of the University of Pennsylvania under the Joseph H. Lauder Institute of Management and International Studies.

He is a proud product of the public school system, having completed primary and secondary education in public schools. To this day, one personal advocacy is to support scholars from his alma mater, Ramon Magsaysay High School.

The son of an elementary school teacher and an entrepreneur who ran a cottage business that produced window decorations like Venetian blinds, Roman curtains, aluminum screens and other fabricated materials, Ysmael is the eldest in a brood of four. As a young boy, he helped sew products during his free time.

He remembers living in a rented house in Sampaloc and going to school on foot, and choosing to go to UE in college because its campus was near his residence. From an early age, he told himself that he would make a difference and uplift the economic stature of his family.

He got admitted to both the University of the Philippines and Ateneo de Manila University and was offered scholarships in each. But in Ateneo, the scholarship covered only the tuition but miscellaneous expenses were as high as the tuition. He also got admitted to UP’s BAA five-year (Business Administration and Accountancy) program, but he wanted to start working right away and didn’t want to spend an extra year in college. In UE, however, he got a free-tuition scholarship package and likewise got an allowance under a separate scholarship provided by the Inner Wheel Club. Best of all, UE campus was just a 15-minute walk from his house. He would take public transportation only when he’s in a hurry.

Ysmael (right) shakes hands with Ayala group’s Fernando Zobel de Ayala with former ALI CEO Tony Aquino looking on

When he became a CPA (ranking among the top 15 in the board), his first employer was SGV. This firm imbibed work ethics in him and opened a lot of doors for him, picking him as one of the scholars set to study in the United States, where he obtained his graduate degrees. From there, he also went into an immersion program in Latin America. A few years later, he would go back to the US for a year-long internship at the Baltimore office of Arthur Andersen, which was then SGV’s international partner firm.

He worked at SGV for almost 11 years. He was senior manager and just about to be made partner when he decided to “cross over” to the corporate side.

In 1991, he joined Ayala Corp.’s strategic planning group, handling Ayala Land while also being involved in other businesses like Globe Telecom, car dealership, IMI and Ayala International. He joined Ayala Land full time in 1995, and since then worked with four presidents of the property giant—Francisco Licuanan, Jimmy Ayala, Tony Aquino and Bobby Dy.

These days, Ysmael is himself CEO of a property company. It’s a much smaller company, currently employing 170 people, but with an enviable land bank which will take 20 to 30 years to develop.

In the future, OCLP may need fresh equity, depending on how fast it will be able to ramp up different businesses.

“An IPO (initial public offering) is a possibility in the future,” Ysmael says.