The local stock barometer slipped for the fourth straight session on Friday as investors priced in forthcoming stock weight adjustments in closely tracked MSCI indices while geopolitical jitters curbed risk-taking.

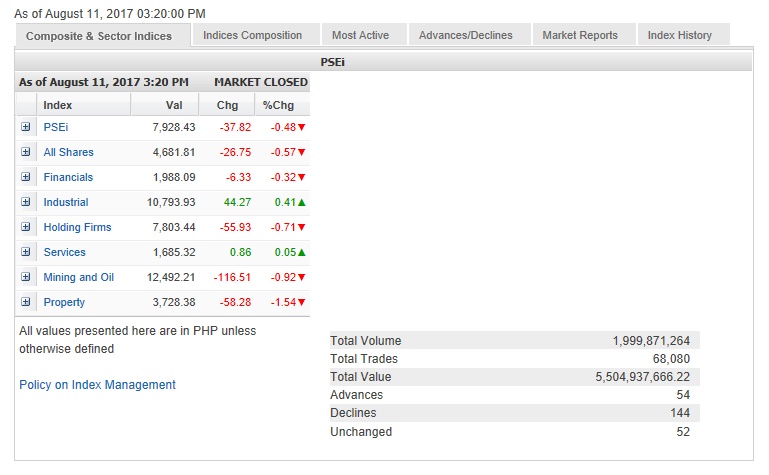

The main-share Philippine Stock Exchange index shed 37.82 points or 0.48 percent to close at 7,928.43, tracking the downturn across regional markets as hostile rhetoric between the United States and North Korea over the latter’s missile threats escalated.

By counter, the PSEi was weighed down most by the property sub-index, which fell by 1.54 percent as the latest MSCI rebalancing showed weight reduction in property giants SM Prime and Ayala Land, which respectively slipped by 2.17 percent and 1.29 percent. There was also a weight reduction on BDO, which fell by 0.54 percent.

The latest MSCI rebalancing will take effect at the close of trades on Aug. 31.

Aside from the property index, the financial, holding firm and mining/oil counters also slipped while the industrial and services counters eked out modest gains.

Megaworld slipped by 2.45 percent while conglomerate GT Capital fell by 1.97 percent after announcing a 21-percent decline in six-month net profit to P7.24 billion due to recognition of gains from the sale of investments in the same period last year.

Jollibee, Ayala Corp., Semirara, EDC and MPI also slipped.

Outside of the PSEi, notable decliners included newly listed Chelsea, which fell by 4.1 percent while D&L and CNPF declined by 2.47 percent and 1.33 percent.

Security Bank, the day’s most actively traded stock, bucked the day’s downturn, rising by 3.28 percent as the bank benefited from an increased MSCI weight.

URC rebounded by 2.51 percent while PLDT rose by 1.64 percent after reporting that it had arrested the decline in revenues as of the second quarter.

JG Summit, ICTSI and Puregold slightly gained.

Apart from the MSCI rebalancing factor, rising tension between the US and North Korea also continued to hurt investor sentiment.