The local stock barometer ended flat yesterday as jitters over North Korea curbed risk-taking across regional markets.

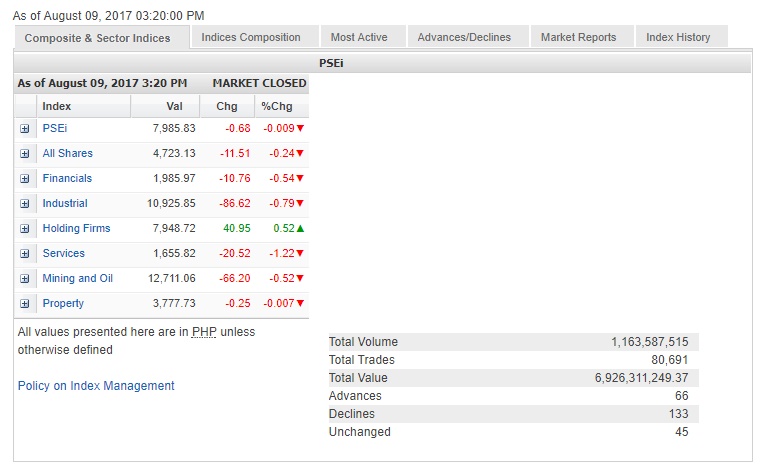

The main-share Philippine Stock Exchange index (PSEi) shed 0.68 point or 0.009 percent to close at 7,985.83, slipping for the second straight session.

Across the region, stock markets were mostly lower as US President Trump traded barbs with North Korea. Trump warned that further threats from North Korea would be “met with fire and fury” while North Korea threatened to strike the US-held Pacific island of Guam.

“Philippine shares traded at a sluggish pace with little fanfare to the tune of all the three major US equity benchmarks finishing lower yesterday by 0.20 percent as Trump warned North Korea,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

The month of August is historically a weak period for stock trading in the local market.

Domestic investors were the ones dumping shares as foreign investors were net buyers amounting to P342.71 million for the day.

The decline was led by services, which fell by 1.22 percent. Only the holding firm counter ended higher, albeit modestly.

Total value turnover for the day amounted to P6.93 billion. There were 133 decliners that overwhelmed 66 advancers while 45 stocks were unchanged.

The PSEi was led lower by ICTSI and PLDT, which both slumped by more than 1 percent. URC, EDC, Metrobank, BDO, Security Bank, Semirara and Jollibee also lost ground.

Newly listed Chelsea tumbled for the second day since its stock debut, losing another 4.92 percent. As the company’s recent offering was mostly bought by retail investors, lack of institutional support resulted in weak post-listing trading. It was the most actively traded company for the day.

Outside the PSEi, another notable decliner was D&L, which tempered its full-year profit growth forecast to single-digit from double-digit, citing infrastructure constraints that might affect sales volume.

Vitarich also slid by 12.85 percent while East West gave up 1.85 percent.