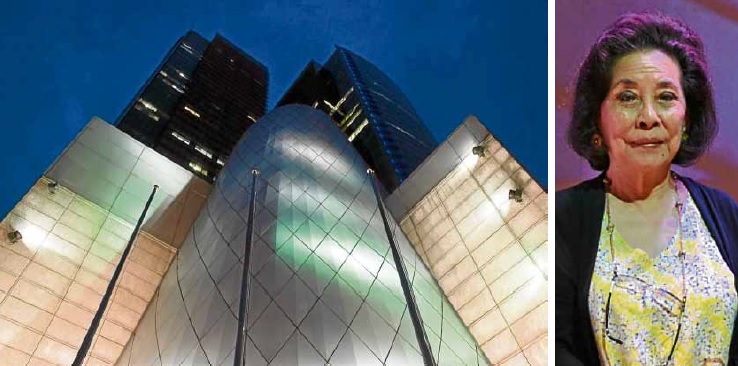

RCBC has weathered crises under the steady hand of its chair, Helen Yuchengco-Dee (right) —RCBCPLAZA.COM

Rizal Commercial Banking Corp. (RCBC) was in the news in 2016 because of the Bangladesh heist, adversely affecting its reputation despite its innovative and differentiated banking services that have won it numerous awards.

Its stock price, however, has gone up by over 50 percent (as of end-July 2017) versus year ago.

In an exclusive interview, RCBC chair Helen Yuchengco-Dee talks about the importance of differentiation in the marketplace, as well as internal preparedness, emphasizing the importance of business continuity, risk management and building a resilient culture.

Q1: RCBC’s Wealth Management Group, which is in charge of taking care of high net worth individuals (HNIWs), has consistently been voted by Asiamoney as the best domestic private bank in the Philippines annually since 2012. Please share with us what HNIWs are like and how your bank has addressed their needs?

A1: We are now looking at the second and third generations of HNWIs.

While the first generations are more conservative in terms of risk appetite, the younger generations are more open to investment ideas that they come across with via different sources: Bankers, internet, friends, relatives, business partners, everywhere. It is from various inputs and sources that they base their investment decisions on.

As a business group, RCBC Wealth Management is mandated to service all the investment requirements of its high value clients.

Adopting an open architecture platform, it is able to source products externally, if what the client wants is not among the bank’s own product offerings.

To ensure that what the client eventually gets is an investment vehicle that truly matches his/her investment appetite, our Wealth Management personnel are also tasked to fully know and understand their clients, in terms of their personalities, aspirations, financial needs, etc.

Q2: Asiamoney also polled corporate clients and financial institutions and awarded RCBC’s Treasury Group the best domestic provider of foreign exchange (FX) services and options. What is it that differentiates you from other banks in FX and how does RCBC organize itself to deliver this value for them?

A2: Last year was not the first time that RCBC Treasury won in the prestigious Asiamoney awards.

Over the past five years, Treasury customers polled by the publication have always cited us, voted for us, and placed us as among their best service providers in the Philippines.

We see three key competitive advantages which have allowed us to win these awards, including the ultimate, Asiamoney Award as the Best Philippine Bank in Forex Sales and Trading.

These are competitive pricing, innovative client solutions and, most importantly, the personalized service that is consistently provided by our passionate and hardworking colleagues in Treasury.

Q3: Cards and Electronic Payments International (CEPI) Asia proclaimed RCBC Bankard the best credit card offering in Southeast Asia for 2016. What unique card features do you have and what was the thinking process behind the creation of these features?

A3: Over the past years, RCBC Bankard has consistently been winning awards from prestigious international bodies for various reasons.

However, the most noteworthy award that we received was from the Cards & Electronic Payments International (CEPI) Awards which named RCBC Bankard the Best Credit Card Offering in Southeast Asia, surpassing all other regional competitors.

The award recognized our innovative offers like the Most Flexible Rewards Program and the All-in Rewards, which both allowed cardholders to get more out of the reward points they earned from using our card.

In coming up with distinct card benefits, we put our cardholders’ concerns and aspirations on top.

We know that for some, the credit card can feel like a debt trap. This is the concern addressed by proprietary budgeting tools, including an SMS alert that reminds the cardholder that he is about to reach his personalized set budget; and a categorized Spend Analyzer that will let him track his spending habits.

Another unique benefit is called Unli 0%—this allows cardholders to pay for any and all of their card purchases in three months with no interest. To ensure purchase security, we have migrated our cards to EMV ahead of the BSP mandate.

On top of all these, cardholders also enjoy a privileged and rewarding experience with generous travel benefits across all card types.

Q4: RCBC does a lot of business with small and medium scale enterprises (SMEs) as well but there are many inefficiencies in helping SMEs build their business from scratch. Years ago, RCBC launched getaloan.com.ph, what was the idea behind this website and what were the results?

A4: Getaloan.com.ph is RCBC’s response to the BSP’s call for banks to make themselves more accessible to the SME market.

It is an internet-based self-assessment service that allows people to find out whether or not they are qualified for a loan. The tool saves them time as well as prepares them to compile the right documents for submission once they qualify for a loan. Two years after its launch, getaloan.com.ph now posts 1,500 unique visits per month, indicating a strong interest from the sector.

It has also contributed to the

24- percent growth of our SME portfolio in the same two-year period. I’m proud that this effort has been recognized with several local and international awards.

Q5: What else have you been doing to create inclusive growth?

A5: Ensuring inclusive growth requires doing a lot of things.

First of all, we have to continuously increase our presence to ensure accessibility. In our case, not only did we have to expand our wings to cover even the most remote areas in the country, we also had to make sure that we have enough manpower to reach out and serve the needs of our clients.

The portion of the market that is not reached by our brick and mortar is given access via our online presence.

Secondly, we have to broaden the scope of our clientele to include small players and those in the auxiliary services. The bigger clients will not reach their full potential if the smaller groups working in the same eco-system are not similarly supported to succeed.

As an institution, we deliberately and consciously advocate financial literacy by providing people with the tools that will enable them to grow their businesses further.

Efforts to continuously build deeper client relationships through fellowships and face to face interactions, also help.

Specifically for women, the bank launched the eWMN program in 2012 in partnership with the World Bank’s International Finance Corp.

Q6: RCBC has been recognized as an excellent case for business continuity and risk management. Can you share a more recent example of resiliency amid struggle?

A6: The challenges faced by the bank in 2013 in connection with the devastation suffered by its Tacloban branch from Super Typhoon Haiyan (Yolanda), may be considered not just one of the hardest that we had to hurdle but also a shining success story for us in recent years. It was a crisis that saw the bank’s different units working closely together to immediately restore business operations. More importantly, the team was able to provide the people of the heavily-damaged area access to their much needed financial services at the soonest time possible.

By activating RCBC’s previously laid down Business Continuity, Disaster Recovery and Crisis Management Plans, which necessitated ensuring the safety and well-being of our employees in the area; quick equipment purchases to replace all that were damaged by the typhoon; and putting in place leased lines that ensured connection to our main systems, RCBC’s Tacloban branch managed to re-open its doors to its customers on Nov. 20, 2013. This was just 10 days after the typhoon struck. That made RCBC the first bank to operate in Tacloban after the disaster.

Of course, another recent example would be last year’s issue, in connection with the Bangladesh heist.

It was a crisis that put the bank’s reputation at risk, which, if left unaddressed, could have translated to significant negative impact.

In our case, we chose to act within the legal options available to us and welcomed all the allegations thrown at us as an opportunity to conclusively prove that the bank had totally no deliberate involvement in the case.

Internally, we chose to be transparent to our employees with how the whole issue was progressing.

I personally sent them messages which encouraged them to just continue providing the best service to our customers. Our efforts to regularly meet with clients and apprise them about the issue likewise helped erase whatever initial concerns they may have had and they decided to continue banking with us.

Some of our loyal customers even put out a good word for the bank on print and that was something we really appreciated.

In the end, I believe that what’s important for organizations to do at a challenging time is to rally their troops to be strong and united, never losing sight of their purpose and commitment to deliver customers’ expectations.

Q7: What does it take to attain a resilient culture?

A7: A company should not wait for a difficult situation to happen before it puts in the efforts that will enable it to survive it.

Resiliency doesn’t happen that way. Resiliency is a product of readiness, of preparing for exigencies before they even happen.

The moment a crisis strikes, it will all be a matter of putting all contingency plans in action, in order to see you through the difficult period.

At the height of a crisis, the important things are: 1) ensuring the shortest recovery time possible or something that falls within the BSP mandated recovery period; 2) keeping the business at a Business As Usual mode; and 3) making sure that people’s morales are managed.

Q8: CIR Magazine recognized RCBC also for helping clients attain stability via business continuity and risk management. What value-added services do you offer in this aspect and what impact on business have you observed as a result of this service?

A8: To clarify, RCBC was awarded by Continuity Insurance and Risk (CIR) Magazine, London for its paper titled “Synergistic Approach for Destructive Earthquake Preparedness of RCBC & YGC.”

The paper described how RCBC embarked on a group-wide crisis awareness project and employed synergy in disaster preparations in the eventuality of a major earthquake.

This, plus our learnings in facing past disasters, including our experiences during Typhoon Haiyan, only strengthened our crisis response and recovery capabilities.

Our clients can be assured that we have the ability to be up and running for them even at a time of crisis or any other major incident.

These efforts, as well as the affirmation through the CIR Business Continuity award, have helped improve the bank’s image resulting in increased confidence of our customers.—CONTRIBUTED