The much-anticipated legislation of the first phase of the Duterte administration’s tax reform program this year will propel the local stock barometer to as high as 8,700 by end-2018 as tax cuts put more money into consumers’ pockets, regional investment house CLSA projected.

In a 112-page special report in July titled “Tax us, please!” written by the Philippine research team led by Alfred Dy, CLSA analyzed the impact of the tax reform program, the first package of which is targeted to raise P133.8 billion or 0.8 percent of gross domestic product (GDP) in 2018.

“Tax hikes are rarely met with cheers but the Comprehensive Tax Reform Program (CTRP) is something to celebrate,” the study said.

CLSA commissioned a nationwide survey of 1,200 Filipinos aged between 21 and 59 across seven income brackets to gain a glimpse of how the proposed CTRP package 1— and particularly the lowering of personal income tax— would affect consumption.

“All told, average take-home pay could increase by 7 percent from which our respondents hope to save 26.9 percent of the incremental earnings with the remaining 73.1 percent going to consumption,” the research said.

The survey also suggested that banks would benefit from more deposits and loans while retailers could be winners too as people allot an extra 13.8 percent for groceries, CLSA said.

Telecommunication companies are also seen to gain as CLSA’s respondents said they would spend 2.8 percent more on mobile load and 3.3 percent more on broadband.

Quick-service restaurants were also identified as potential beneficiaries, with 4.3 percent slated for dining out, while travel was also seen to get a boost, taking 3.4 percent of the bigger wallet.

However, the study noted that higher excise tax might cause a short-term slowdown in growth in the automobile sector.

On personal income tax, CTRP package 1 seeks a shift from a flat 30-percent to a progressive tax rate wherein individuals who earn more are taxed higher, while individuals who earn less than P250,000 a year will not be taxed at all. Those who earn P5 million or more a year will be placed in a maximum tax bracket of 35 percent.

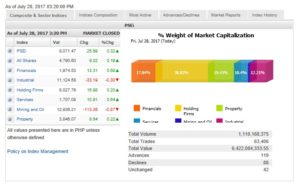

Assuming that package 1 will be passed within this year, CLSA reiterated its “bullish” market view, upgrading its yearend 2018 Philippine Stock Exchange index (PSEi) target from 8,600 to 8,700, while affirming its end-2017 target of 7,900.

Given that in the last five years the PSEi has traded at an average price-to-earnings ratio of 18.4x, CLSA said it seemed that the market was “fully valued this year but still has some considerable upside in the next 18 months.” A price to earnings ratio of 18.4x means investors are willing to pay 18.4 times the kind of money they expect to make from companies in the PSEi basket.

Investors should focus on the key beneficiaries of Package 1, particularly those who stand to benefit from the higher disposable-income windfall. These companies are Ayala Corp., Globe, Jollibee, Metro Pacific, PLDT, Puregold, Robinsons Retail and Security Bank, CLSA said.