The Bangko Sentral ng Pilipinas and five other central banks in Asia are seen keeping policy rates low amid subdued inflationary pressures, the Washington-based Institute of International Finance (IIF) said.

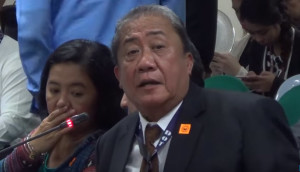

“While policy rates have largely bottomed out in the region, the ‘Asia Six’ central banks are likely to keep them around current low levels over an extended period,” IIF chief economist for Asia-Pacific Bejoy Das Gupta said in a July 25 report titled “Economic Views (Asia Six): Why in No Hurry to Alter Monetary Policy?” Besides the Philippines, the IIF was referring to the following five other Asian countries: India, Indonesia, Malaysia, South Korea and Thailand.

Across these six countries, “inflationary pressures are subdued and central banks are looking through some temporary overshooting in Indonesia and Malaysia as well as substantially below-target inflation in India and Thailand,” Das Gupta said.

In the case of the Philippines, headline inflation averaged 3.1 percent as of end-June.

In a recent report, the BSP said it expected the rate of increase in prices of basic goods to settle “near the midpoint of the government’s target range of 2 to 4 percent in 2017 to 2019.”

“Inflation is projected to peak in the third quarter of 2017, driven by positive base effects and the continued strength in domestic economic activity before reverting to the midpoint of the target range in 2018-2019,” according to the BSP.

Also, Das Gupta said “strong external positions, evident in current account surpluses or small deficits, appreciating currencies and some reserve addition, also meant the region was under no pressure to follow the Fed.

So far this year, the US Federal Reserve already raised interest rates twice, with another rate increase expected before the end of the year.

“Equally, Asia Six central banks do not wish to further lower policy rates as they worry about financial stability while growth is receiving support from revived exports, fiscal programs and structural reforms,” Das Gupta said.