PH shares close at 11-month high, revisit 8,100 mark

The local stock barometer revisited the 8,100 mark on Thursday following the US Federal Reserve’s “dovish” signal but pared gains at the close.

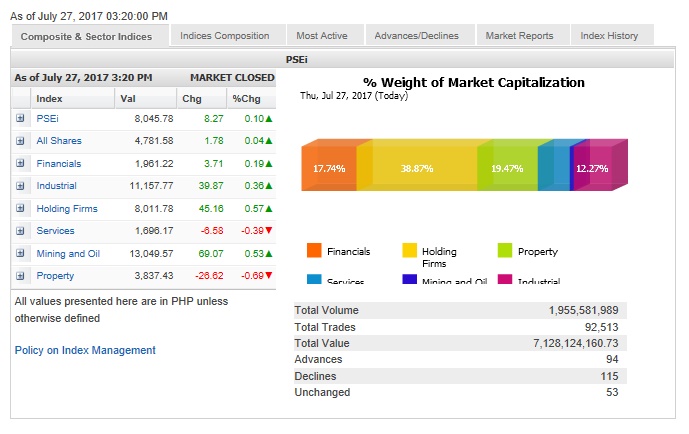

Tracking upbeat regional markets, the main-share Philippine Stock Exchange index added 8.27 points or 0.1 percent to close at an 11-month high of 8,045.78.

The index hit a high of 8,106.74 in intra-day trade before closing at the intra-day low.

“The FOMC (Federal Open Market Committee) statement didn’t break unexpected ground, but by not being hawkish, the statement validated the recent dovish shift in expectations of a flatter hiking trajectory. The statement suggests that future rate hikes will depend on the evolution of inflationary pressures, but confirms that balance sheet reduction will commence relatively soon,” Citigroup said in a research note.

Markets now price less than 10 basis points of tightening this year, with less than 40 percent probability of another 25-basis point hike, and only 32-bp in cumulative additional tightening by the end of 2018, Citi said.

“This is also fairly supportive for emerging markets (EMs): capped yields, a softer dollar, strengthening commodities, and robust equity markets supported by healthy corporate results make a solid foundation for further EM strength. In addition, the EM business cycle remains in an upswing, China continues to deliver positive data surprises, and positioning is in many instances in EM Asia still somewhat light despite the large aggregate allocations to EM this year,” Citi said.

At the local market on Thursday, market breadth was negative despite the PSEi’s rise. There were 115 decliners that edged out 94 advancers while 53 stocks were unchanged.