Just when some thought that the aging bull is losing steam, investors have found new reasons to keep charging on.

At the beginning of this year when we surveyed 10 brokerage houses, the consensus was that the Philippine Stock Exchange index (PSEi) would rise from last year’s level but very few projected that the stock barometer could set new highs or even retest 8,000 levels.

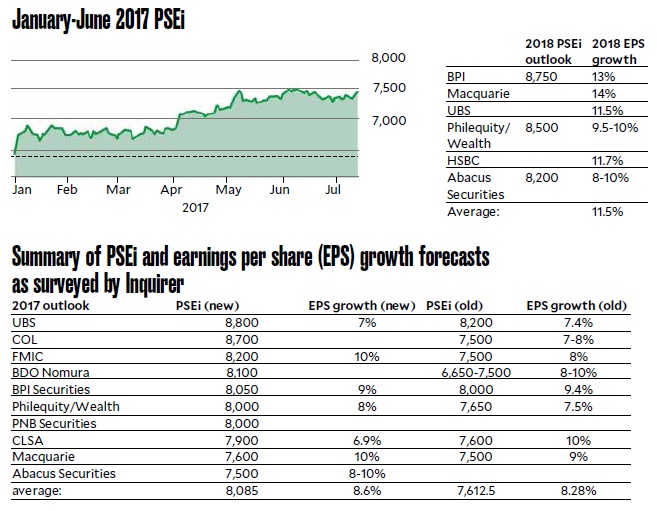

The PSEi is now projected to rise to an average of 8,085 this year, based on our mid-year survey. This suggests a gain of 1,244.36 points or 18.2 percent from last year’s finish of 6,840.64. This indicates greater optimism compared to the consensus PSEi outlook of 7,612.5 at the beginning of the year even if there was hardly any upgrade in earnings forecasts.

Based on our survey, corporate earnings are seen to grow by 8.6 percent, hardly improving from the consensus at the beginning of the year, as investors factored in actual earnings performance in the first quarter.

Thus, most upgrades in the PSEi outlook for the year were not quite about corporate earnings for the year, where growth prospects are not as exciting as in previous years. It’s more aligned with recent movements in the market.

The Philippine stock market attracted P22.04 billion in net foreign buying in the first semester on the back of an improved global outlook and optimism on the government’s tax reform agenda. The PSEi gained 14.7 percent from the start of the year to close on June 30 at 7,843.16. All sectoral indices also posted gains with the services index up the most by 29.5 percent.

Trading activity was also brisk during the first half, with daily average value turnover rising by 7.5 percent to P8.08 billion from the level in the same period last year.

There was a much-awaited breakout on April 4 when the PSEi breached the psychological resistance at 7,400 due to expectations of at least 7-percent gross domestic product (GDP) growth in the first quarter. The market has consolidated in a higher range since then, attempting to conquer 8,000 several times in the year—even when the country’s GDP growth came in disappointing at 6.4 percent, even when a band of terrorists affiliated with ISIS brought havoc in Marawi that prompted President Duterte to declare martial law in the whole of Mindanao and even when the peso has weakened against the dollar.

“We are pleased with the overall market performance in the first semester while capital raising activity remains on target. We believe the economy will continue to provide more growth for listed companies and attract more investors in the market,” PSE president and chief executive Ramon Monzon said.

“The passage of the tax reform bill and the infrastructure program of the government should help sustain the market’s growth momentum in the coming years,” Monzon added.

With the comprehensive tax reform program (CTRP), the government hopes to bring more money to the pocket of consumers while funding the government’s “build, build, build” infrastructure agenda. The House of Representatives passed the first phase of the tax reform package after this was certified by Mr. Duterte as an urgent piece of legislation.

This package simplifies and lowers personal income tax rates while broadening value-added tax coverage, rationalizing estate and donor’s tax and adjusting oil and automobile excise taxes. Additional revenues from this package area also targeted to fund the government’s build-build-build infrastructure program. The House version meets the minimum reforms sought by the Department of Finance. All eyes are now on how the Senate version would shape up.

This is set against the backdrop of what many analysts believe to be a much-improved global operating environment that has brought back foreign fund flows to emerging markets like the Philippines. “This eight-year global bull market may be old, but we don’t think it is finished,” said global banking giant Citi, whose strategists projected a 9-percent gain for global equities by mid-2018.

Despite Great Britain’s decision to exit from the European Union, the euro-zone is seen faring well. And despite US President Trump being a magnet for political controversies, confidence in the US economy has risen and the US Federal Reserve’s raising of interest rates after a long period of accommodation is only seen as an indicator that the US economy is strong enough to resume a normalized interest rate regime.

Conquering 8,000

Based on our mid-year survey among local and foreign institutions, seven out of 10 now expect the PSEi to end this year above 8,000. Three even see the possibility of the local stock barometer setting new highs this year.

The PSEi’s all time high closing was at 8,127.48 seen on April 10, 2015. So far this year, the PSEi has seen profit-taking whenever it breaches or even moves close to the 8,000 mark.

UBS has the most upbeat forecast on the PSEi so far at 8,800 . It was only among the two institutions (aside from BPI Securities) that had projected early in the year that the PSEi would break 8,000 this year. Nonetheless, UBS has upgraded its outlook for the year from its earlier forecast of 8,200 even without any upgrade in its earnings forecast.

Leading online stockbrokerage COL was expecting the PSEi to reach only 7,500 at the beginning of the year but has now upgraded its forecast to 8,700.

“It was largely a function of reducing our risk premium estimate factoring in the increasing likelihood that the CTRP would be passed and the improving operating outlook of numerous industries, plus an upgrade on SM Prime Holdings (SMPH) and SM Investments Corp. (SMIC), factoring in the reclamation projects,” COL head of research April Lee-Tan said.

SMPH and SMIC are the two most valuable companies in the Philippines to date, each valued by the stock market at close to P1 trillion.

To reflect its improving outlook of the economy and the various sectors, COL has reduced its risk premium assumption by 50 basis points to 5 percent after raising it in October 2015.

Philequity/Wealth Securities group also upgraded its outlook for the PSEi this year through 2018 while projecting an average earnings per share (EPS) growth forecast of 8 percent.

In an interview, Philequity founder and director Wilson Sy said assuming that the CTRP would be passed in a form that won’t dilute targeted revenues by the government, the PSEi would sustain its climb to 8,000 and further to 8,500 next year.

“It’s important that it’s not watered down,” Sy said. “We need this if we want government to continue spending to fuel growth and it’s the right time because oil prices are down.”

Apart from lowering personal income taxes, the DOF’s proposal is to raise oil excise taxes by P6 gradually over three years and indexed yearly after the third year. Rates of oil excise have not been adjusted since 1997. Aside from boosting government revenues, this proposal seeks to address environmental and health problems.

Sy said the PSEi target next year might still be upgraded if the CTRP is passed and implemented and the final form is in line with the DOF recommendation. “The upgrade may come in the form of upward earnings revisions due to stronger consumer spending power and a re-rating of the market as a result of the reforms,” Sy said.

On the conflict in Mindanao, Sy said this had not weighed down market sentiment because investors have come to realize that geopolitical risks existed anywhere in the world, noting that even global financial hubs like London had their own share of terrorist attacks. “What they are concerned about is economic growth,” Sy said, adding that Mindanao was not the topmost concern of investors at this point.

On the weakening of the peso against the dollar and concerns on the Philippines’ current account incurring a deficit this year, Sy said one major reason was the importation of oil. In the first quarter, he noted that global oil prices have increased by about 50 percent year-on-year, thereby increasing the country’s import bill. At the same time, he noted the front-loading in the importation of automobiles to meet market demand ahead of the anticipated increase in taxes. At the same time, he said there was a surge in the importation of capital goods to cover the expansion of various companies.

Investors are typically wary of volatility in the exchange rate because this reduces the value of their local assets. But by next year, he said the country’s external accounts might normalize.

Investment house First Metro Investment Corp. (FMIC) also upgraded its PSEi forecast this year to 8,200 from an earlier outlook of 7,800, noting that corporate earnings were likely to grow at a faster pace despite a slower-than-expected Philippine economic growth rate. FMIC expects a 10-percent growth in core EPS compared to 8 percent previously. The earnings forecast includes only recurring earnings and takes out the impact of the telecommunication sector, which is deemed an outlier.

This is even as FMIC now sees Philippine GDP growing by 6.5-7 percent this year, slower than the 7-7.5 percent expectation in the beginning of the year.

FMIC’s upgraded forecast for the PSEi assumes that the stock market will trade at a price-to-earnings ratio of 19x, which means investors will be willing to pay 19 times the amount of earnings they expect this year.

FMIC head of research Cristina Ulang said benign inflation and excess financial liquidity were keeping the cost of money low, boosting corporations and consumers alike. “If you have affordable cars, affordable condominiums, you’ll see construction continuing and infrastructure is really key to industry growth,” she said.

She said business and consumer confidence would likely continue amid the country’s progress in the areas of poverty alleviation and job creation. At the same time, she noted that US President Trump’s protectionist policy has not affected BPOs whilen remittances continued to grow.

“To summarize, the whole economy may not be moving as fast as many parts of the economy are slow, like agriculture. But most of the listed companies are hardly in agriculture. So those growing faster are the very good sectors, like the consumer (sector). Some sectors are moving faster than the general economy. That’s the reason for the higher growth (outlook for corporate earnings),” FMIC president Francisco Sebastian explained.

Muted view

Based on our survey, Abacus Securities has the most muted view on the PSEi this year, expecting the local stock barometer to end the year at 7,500. However, it expects the index to surge to 8,200 by next year.

Abacus head of research Raymond Neil Franco explained that the modest view on the index reflected tepid EPS growth for both years, noting that in the first quarter of 2017, actual earnings growth was only at 6 percent on core or recurring profits basis.

“Also, (it’s due to) global central bank normalization (of interest rates), concerns on Philippine fiscal side and I personally believe (that) HB 5636 (CTRP) will hurt consumer sending for one to two years after implementation if it passes the Senate in its current form,” Franco explained.

Franco is concerned that the proposed reduction in personal income taxes won’t be enough to offset additional burden arising from the proposed increase in other taxes such as on oil, automobiles and sugar-laced beverages.

“Out of 14 to 15 million registered taxpayers, five to six million are actual taxpayers since many/most are already tax exempt, are retired or evade taxes altogether,” Franco said. “So, only five to six million or 5-6 percent of the population will benefit from lower income taxes but 100 percent of Filipinos will feel the impact of higher fuel and sugar tax, removal of (VAT) exemptions and higher inflation.”

For its part, Citi said in its quarterly equity research note dated July 4 that an earnings recovery was underway in Asia, most visibly among the cyclical sectors. “Analysts’ earnings revisions are skewed to the upside, but more so for North Asia than Asean as operating leverage has increased more for the former,” it said.

Citi is “overweight” on Singapore, South Korea and Taiwan, “neutral” on China and Malaysia but “underweight” on the Philippines, Hong Kong, India, Indonesia and Thailand.

“Underweight” refers to a recommendation to pare down holdings relative to a benchmark index, usually the MSCI global index where the prescribed allocation for the Philippines is only 1.4 percent compared to 32 percent for China, 2.8 percent for Indonesia, 2.7 percent for Malaysia and 2.5 percent for Thailand.

On a regional basis, Citi is overweight on the eurozone, underweight on UK and Australia, neutral on the US and generally neutral on emerging markets.

“The biggest risk to our view remains a significant global slowdown and lack of earnings delivery. We are too bullish and pro-cyclical if that occurs. We are also concerned about the markets’ reaction to monetary tightening,” Citi said.

Since global growth is happening, Philequity’s Sy said emerging markets like the Philippines were growing as well. “So when the US raises rates, it’s a good signal. If it doesn’t increase, that means growth is slow. So interest rates are going up now and it’s a good thing,” Sy said.

“We don’t really mind rising interest rates. In fact the concern now is being left behind the curve,” Sy said.

Stock experts are also looking forward to better prospects for 2018. By then, they hope to see more developments on the Duterte administration’s tax reform package and ambitious infrastructure spending. There have been doubts raised on the government’s growing preference for hybrid public-private partnership (PPP) projects as opposed to outright PPP. As opposed to an outright PPP, which involves the private sector right from the planning, designing and construction phase, the hybrid PPP route puts the government in charge of building the infrastructure project—whether using its own funds or by tapping official development assistance (ODA)—and eventually bidding out only the operation and management afterwards.

Whichever route is taken by the government, for as long as it achieves the goal of easing infrastructure bottlenecks in the country at the soonest time possible, Sy said investors won’t mind.

By next year, most forecasts point to the PSEi breaking new highs and corporate earnings returning to a double-digit growth of 11.5 percent.

Although the month-on-month return of the PSEi was often negative in the month of August based on historical performance, the average return six months later was positive at 4.5 percent, COL said.

“That said, investors should take advantage of any correction in the short-term to accumulate stocks as this could be the last time for the PSEi to trade below 8,100 before it breaks out to much higher levels,” COL said.