PH equities succumb to profit-taking

The local stock barometer succumbed to profit-taking yesterday after initially tracking a regional upswing driven by US Federal Reserve Chair Janet Yellen’s signal that there was no need to fast-track the pace of US interest rate hikes.

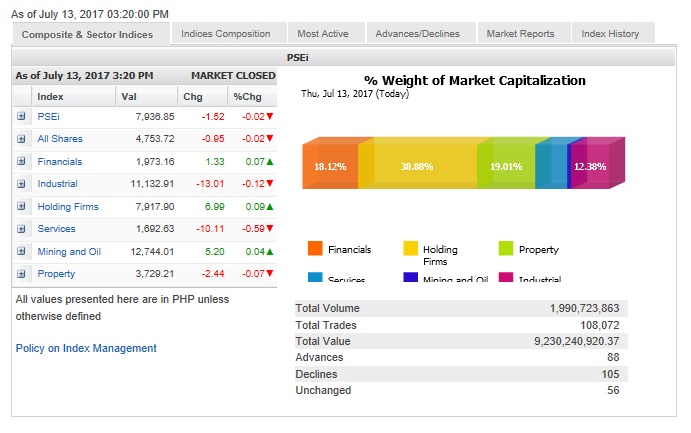

The Philippine Stock Exchange index (PSEi) shed 1.52 points or 0.02 percent to close at 7,936.85 in mixed trade.

The PSEi was weighed down by the industrial, services and property counters while the financial, holding firm and mining/oil counters firmed up slightly.

The main index hit a high of 7,994.27 in intra-day trade but the 8,000 barrier held firm.

Also, foreign investors were net sellers amounting to P296.71 million.

Article continues after this advertisementThe PSEi was weighed down most by EDC, which fell by 2.04 percent, as well as PLDT and Megaworld, which both slipped by over 1 percent.

Article continues after this advertisementMetrobank, Ayala Corp., SM Prime and Semirara also declined.

Outside of PSEi stocks, Waterfront fell by 3 percent after the hefty run-up in earlier days.

On the other hand, DMCI and Jollibee were both up by over 1 percent while SM Investments, URC, BDO, Security Bank and BPI also gained.

Elsewhere in the region, stock markets traded mostly higher after Yellen’s speech.

“Fed Chair Yellen’s testimony appeared to confirm the message from earlier Fed speakers that slow inflation poses a hurdle to an acceleration of Fed tightening. This should help contain the sell-off in US fixed income markets, boost risk appetite globally, further entrench expectations for low market volatility, and serve to depress the dollar at a time when other G10 central banks are commencing policy normalization,” Citi said in a research note.

“With inflation broadly suppressed, with economic data recovering in the US and beating expectations in China, and with key commodity markets continuing to recover, the global macro backdrop appears to be turning more supportive for EM (emerging markets),” it said.