Local stocks rallied on Wednesday, outperforming regional markets, as investors took encouragement from the local currency appreciation and the prospective resolution of the crisis in Mindanao.

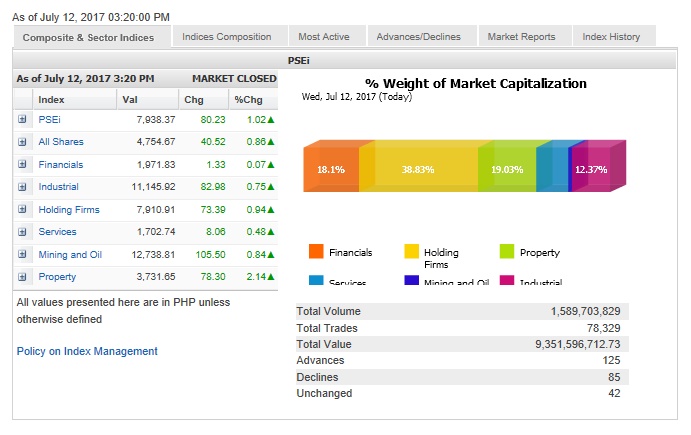

The main-share Philippine Stock Exchange index (PSEi) racked up 80.23 points or 1.02 percent to close at 7,938.37 even ahead of a much-awaited speech by US Federal Reserve chair Janet Yellen.

Joseph Roxas, president of local stock brokerage Eagle Equities, said the market was now moving along the upper end of its consolidation phase.

The market attempted to break the 8,000 barrier a few times this year.

The key drivers on Wednesday, Roxas said, were the recent peso recovery as well as expectations that the almost two-months long Marawi crisis would end soon.

Across the globe, investors were awaiting what Fed’s Yellen would say about the US monetary policy.

At the local market, all counters firmed up but the biggest gainer was the property counter, which rose by 2.14 percent.

Value turnover amounted to P9.35 billion.

There were 125 advancers that edged out 85 decliners; while 42 stocks were unchanged.

Value turnover amounted to P9.35 billion. Net foreign buying for the day amounted to P241.66 million.

Investors loaded up on shares of Megaworld, which rose by 5.3 percent; while Ayala Land, DMCI, JG Summit and Globe all advanced by over 2 percent.

Metro Pacific and SM Prime gained over 1 percent while Metrobank, SM Investments, Semirara, Meralco and PLDT all firmed up.

Non-PSEi stocks that surged in relatively heavy volume included Waterfront Philippines and EEI Corp. which were respectively up by 11.86 percent and 10.64 percent.

Other notable gainers outside the PSEi were retailers SSI and Wilcon, which rose by 2.02 percent and 0.81 percent, respectively.