Selective buying pushes up PH stocks

The local stock barometer firmed up on Tuesday on selective buying ahead of a much-awaited speech by US Federal Reserve chief Janet Yellen.

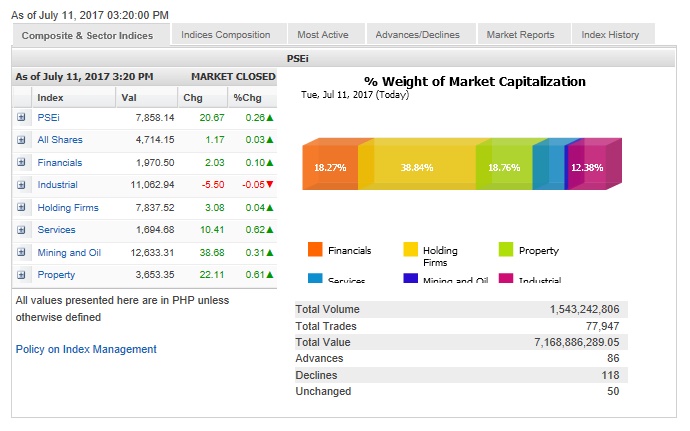

The main-share Philippine Stock Exchange index added 20.67 points or 0.26 percent to close at 7,858.14, tracking US stocks, which firmed up overnight.

At the local market, except for the industrial counter, all sub-indices slipped.

Value turnover for the day amounted to P7.17 billion.

Despite the PSEi’s gain, market breadth was negative as there were 118 decliners that edged out 86 advancers while 50 stocks were unchanged.

In a research note, Citi said global markets had taken a perceptible breather Monday night ahead of important comments by US Fed speakers.

“The thematic macro debate remains focused on whether the repricing of yields in developed markets is complete. We retain the view that this round of the fixed income sell-off driven by position unwinds may now be nearly complete. However, we remain concerned about another set of potential drivers for higher yields: better US data surprises, fading food disinflation, and higher oil prices. We thus remain cautious about duration exposure as well as of having too much EM (emerging market) exposure at this time,” Citi said.

At the local market, the PSEi was led higher by ICTSI, which surged by 3.17 percent while ALI and EDC both gained over 1 percent.

Metrobank, PLDT, SM Prime, DMCI, BDO and Meralco also firmed up.

Outside of the PSEi, notable gainers included Waterfront, which gained 13.46 percent, and FLI, which rose by 3.3 percent. SSI also firmed up in heavy trade.

On the other hand, MPI fell by 1.19 percent while URC, RLC and Security Bank also slipped. GERI fell by 7.82 percent.