The local stock barometer rebounded to the 7,800 level on Friday on the back of selective buying spurred by quarter- and semester-end window-dressing activities.

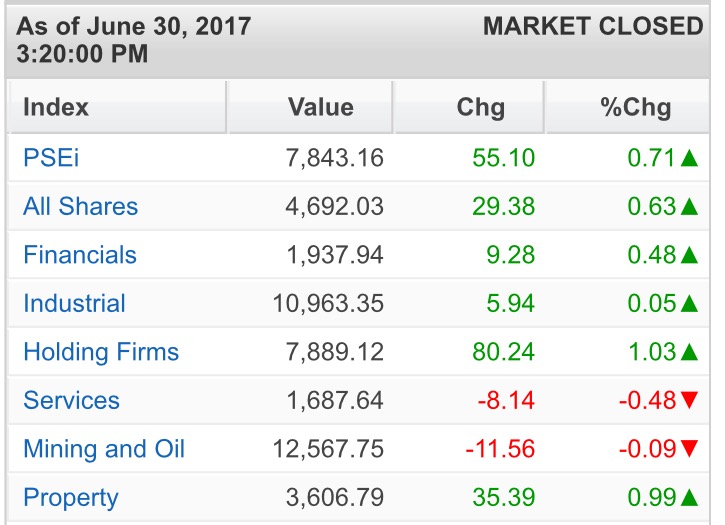

The main-share Philippine Stock Exchange index gained 55.1 points or 0.71 percent to close at 7,843.16, bucking mostly sluggish regional markets.

For the week, the PSEi was a net gainer of 28.99 points or 0.3 percent from last week’s finish of 7,814.17.

Elsewhere in the region on Friday, stock markets were weighed down by hawkish comments from various central banks.

“Philippine markets closed on a positive note this Friday and at the end first half of the 2017 in the much anticipated window-dressing session. The performance shrugged off U.S. performance, as its stocks fell sharply on Thursday, with both the Dow and the S&P 500 suffering their biggest one-day decline since May as the technology sector resumed its downward trend, overshadowing positive news in the financial sector,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

The PSEi was led higher by the holding firm counter, which rose by 1.03 percent. The financial, industrial and property counters likewise firmed up.

On the other hand, the services and mining/oil counters slipped.

Total value turnover for the day stood at P9.9 billion. Foreign investors were net buyers to the tune of P118.61 million.

Despite the PSEi’s gain, the broader market was cautious. There were 118 decliners that outnumbered 89 advancers while 38 stocks were unchanged.

Investors are jittery over the weakening of the peso, which is now trading close to an 11-year low, amid a bleaker outlook on the country’s external account.

Investors picked up shares of large-cap stocks like BDO, which gained 2.48 percent, while SM Investments, Ayala Land and Ayala Corp. all rose by over 1 percent.

SM Prime, Metro Pacific, JG Summit and AEV also contributed to the day’s gains.

On the other hand, Megaworld fell by 2.27 percent while DMCI, ICTSI and Security Bank all declined by over 1 percent.

Outside the PSEi, there was profit-taking on Melco and SSI, which both fell by over 1 percent in relatively heavy trade.