The local stock barometer slipped below the 7,800 mark on Thursday, bucking the upswing in the region, as investors fretted over the weakening peso while others started winding down quarterly trades.

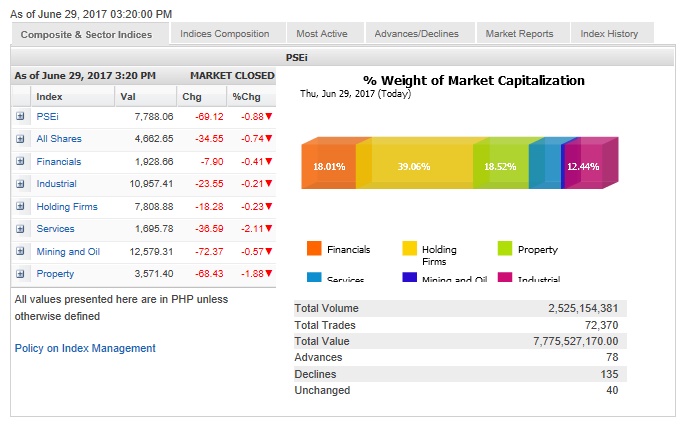

Declining for the second session in a row, the main-share Philippine Stock Exchange index (PSEi) lost 69.12 points or 0.88 percent to close at 7,788.06.

Elsewhere in the region, stock markets were mostly up as investors took their cue from firmer stock trades overnight in Wall Street.

“The peso is weak and it looks like some investors are closing their positions for the second quarter,” said veteran stock broker Joseph Roxas, president of Eagle Equities Inc.

The peso closed at 50.53 against the US dollar, the lowest level seen since September 11, 2006 when it closed at 50.54.

All counters declined but the most battered was the services sub-index, which tumbled by 2.11 percent, while the property counter weakened by 1.88 percent.

Total value turnover for the day amounted to P7.77 billion.

Domestic investors pulled down the market as foreign investors were net buyers amounting to P118.61 million.

There were 135 decliners that edged out 78 advancers, while 40 stocks were unchanged.

Investors sold down shares of PLDT, which tumbled by 3.59 percent. Ayala Land and ICTSI both fell by over 2 percent.

Meralco, DMCI, Megaworld and SM Prime all declined by over 1 percent while Ayala Corp., BPI, Metro Pacific, Semirara, BDO and Security Bank also slipped.

One notable decliner outside the PSEi was Pilipinas Shell, which lost 2.17 percent of its market value.

Newly listed Eagle Cement also succumbed to profit-taking, declining by 1.84 percent ahead of the release of its first quarter results.

On the other hand, SM Investments, URC, Metrobank and JG Summit bucked the day’s downturn.

SSI also continued to rebound, gaining 0.97 percent for the day as investors anticipated a recovery following the retailer’s rationalization program.