The local stock barometer yesterday slipped ahead of the announcement of Bangko Sentral ng Pilipinas (BSP)’s latest monetary policy.

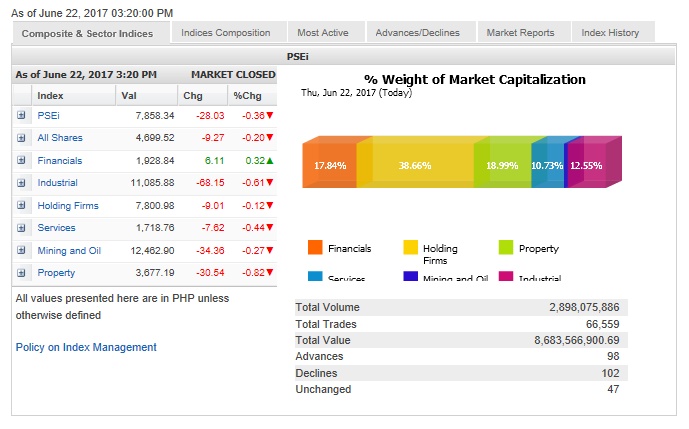

The main-share Philippine Stock Exchange index (PSEi) lost 28.03 points or 0.36 percent to close at 7,858.34.

As expected, the BSP kept its key interest rates unchanged on Thursday.

“Philippine stocks slumped before the BSP released its stance on monetary policy while tracking regional peers. US stocks slumped to a second day of losses, as oil price continued to head lower, dragging energy shares along. A negative start on Wall Street’s leads persisted throughout the day prevented the PSEi to climb above the 20-day MA of 7,920,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

The PSEi’s support is pegged at the 50-day moving average of 7,800, Limlingan said.

Domestic investors were mostly the ones who pared holdings in the local stock market as foreign investors were net buyers amounting to P673.44 million.

Except for the financial sector, all counters declined.

Value turnover for the day amounted to P8.68 billion.

There were 102 decliners that edged out 98 advancers while 47 stocks were unchanged.

The PSEi was weighed down by URC and ALI, which both fell by over 1 percent, while SM Prime, SM Investments, BPI, ICTSI, Meralco and Semirara also slipped.

Outside of the PSEi, notable decliners included Wilcon, which fell by 3.08 percent on profit-taking.

Meanwhile, AGI gained 2.13 percent while Megaworld also rose by 1.54 percent. BDO, GT Capital, Bloomberry, Security Bank, Aboitiz Power and DMCI also firmed up.

On the other hand, notable non-PSEi gainers included Crown Equities and East West Bank, which respectively surged by 10.44 percent and 5.36 percent.