Stocks slip 0.4% track sluggish regional markets

The local stock barometer slipped for the second straight session yesterday as bearish oil prices spooked regional markets.

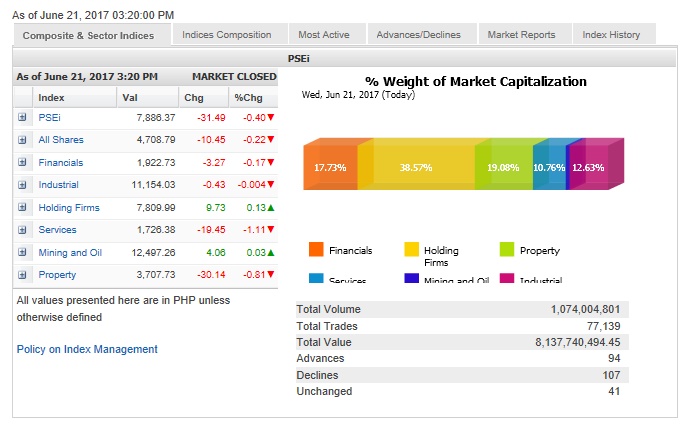

The main-share Philippine Stock Exchange index (PSEi) shed 31.49 points or 0.4 percent to close at 7,886.37, tracking mostly sluggish regional markets as crude oil entered bear territory.

In its regional commentary, Citigroup said: “Falling oil prices are now hurting broader market sentiment. Even though our commodity strategists believe that oil market sentiment is being dampened by ‘misperceptions’, recent price action argues for taking seriously the potential of the knock-on effect to equity, rates and currency markets.”

“Shares were dragged down with US stocks declining, oil prices slumping into a bear market, and the unexpected inclusion of China’s A-shares into the MSCI index,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

He noted that crude futures tumbled to a 10-month low amid worries of a supply glut. West Texas Intermediate (WTI) was down by 2 percent to $43.23 per barrel in Nymex, the lowest since August.

On MSCI’s announcement that China’s domestic A-shares will be included in the MSCI equity index, Limlingan said “inclusion is unlikely to result in a significant shift in the underlying flow picture, in our view.”

“MSCI’s inclusion of A-shares into their indices should help keep market reform in China on track, and should support expectations for bond index inclusions too. This may also support policymakers’ views that portfolio inflows could offset the pressure on China’s balance of payments. That said, at this stage these positives are symbolic,” Citi said.

The additional 0.7-percent weight of A-shares in MSCI Emerging Markets index will come in in two steps in June and September next year. These could result in modest flows amounting to $10 billion to $20 billion, Citi estimated.

At the local market, the day’s decline was led by the services counter, which fell by 1.11 percent while the financial, industrial and property counters also slipped.

On the other hand, the holding firm and mining/oil counters firmed up.

There were 107 decliners that edged out 94 advancers while 41 stocks were unchanged.

The PSEi was weighed down most by PLDT, which fell by 2.41 percent, while Ayala Land, Ayala Corp., Metrobank and ICTSI all declined by over 1 percent.

SM Prime, SM Investments and BDO also slipped.

On the other hand, JG Summit gained 1.92 percent. The conglomerate announced an increase in stake in Meralco.

BPI, Jollibee, Security Bank and Semirara also firmed up.

Investors also picked up shares of companies outside the PSEi.

Newly listed property developer Cebu Landmasters gained 5.55 percent after announcing the ground-breaking of two high-rise projects.

Gaming firm Bloomberry rose by 3.3 percent while Wilcon Depot went up by 2.77 percent.