The local stock barometer pulled back yesterday as domestic investors pocketed gains ahead of the US Federal Reserve’s monetary decision.

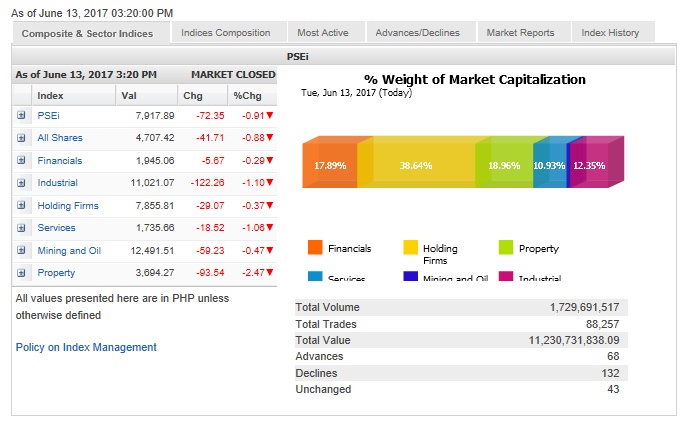

The main-share Philippine Stock Exchange index (PSEi) shed 72.35 points or 0.91 percent to close at 7,917.89.

“It looks like the market is Fed watching,” said Eagle Equities Inc. president Joseph Roxas. “Cautiousness is more a force of habit than fear of an actual rate hike.”

The Federal Open Market Committee is set to meet June 13-14 for its monetary setting.

“We expect the FOMC to look through recent softness in inflation, job gains and wage growth and to still hike its policy rate by 25 basis points. We see potential for a hawkish surprise as median dots are unlikely to move lower despite weak inflation while new information regarding balance sheet reduction may be released,” Citi said in a research note.

At the local market, all counters were down, led by the interest rate-sensitive property counter, which slumped by 2.47 percent, while the industrial and services counters fell by more than 1 percent.

Value turnover for the day amounted to P11.23 billion. Foreign investors, however, remained net buyers for the day amounting to P645.58 million.

There were nearly twice as many decliners (132) as advancers (68) while 43 stocks were unchanged.

The PSEi was weighed down most by Megaworld, which slid by 7.05 percent, while Ayala Land and SM Prime fell by more than 2 percent.

Universal Robina Corp., PLDT, Ayala Corp., SM Investments and First Gen Corp. were all down by more than 1 percent.

On the other hand, BDO and Metrobank also slipped.

Outside the PSEi, investors also sold down several second-liner stocks. Max’s fell by 9.65 percent while DoubleDragon declined by 2.94 percent.