The local stock barometer rallied to the 7,900 mark yesterday after the House of Representatives passed the tax reform bill that was certified as urgent by President Duterte.

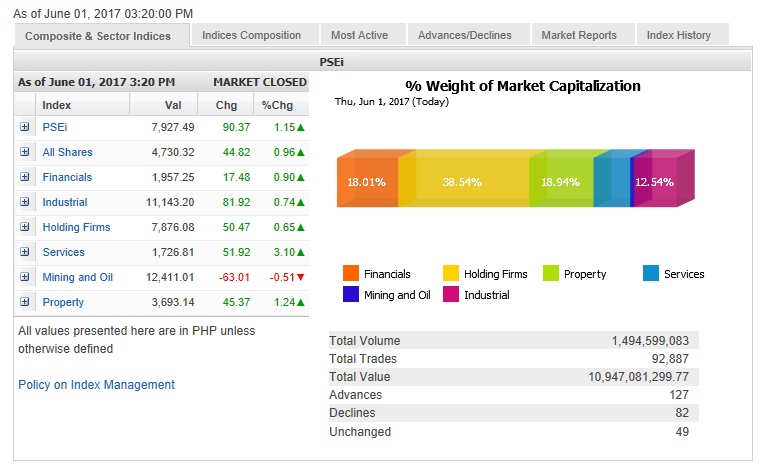

The main-share Philippine Stock Exchange index (PSEi) gained 90.37 points or 1.15 percent to close at 7,927.49.

Voting 246-9-1 before heading into recess, the Lower House passed House Bill 5636, also known as the Tax Reform for Acceleration and Inclusion (Train).

“Philippine markets kicked off June on an optimistic note as buying continued with accompanying volumes. It was taken as a positive sign that the House of Representatives passed on the third and final reading the tax reform bill, which would help add P82 billion in tax collection and aid in the ambitious infrastructure spending of the Duterte administration,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

Likewise adding to the favorable sentiment was the latest report showing that the Philippine manufacturing sector remained firmly in expansion territory in May, underpinned by robust output growth and new orders, Limlingan said.

“The market is still on an upward trajectory, and gaining some momentum on the upside. We may likely retest recent highs, especially with some catalyst expected in the next few days [such as U.S. jobs data],” local stock brokerage AB Capital Securities said in a research note.

The PSEi was led higher by the services and property counters which respectively advanced by 3.1 percent and 1.24 percent.

The financial, industrial and holding firm counters likewise gained.

The mining/oil counter, however, declined.

Foreigners were net buyers in the market amounting to P190.42 million. Total value turnover for the day amounted to P10.95 billion.

There were 127 advancers that edged out 82 decliners while 49 stocks were unchanged.

Investors racked up shares of PLDT and Jollibee, which both surged by over 5 percent while Puregold likewise gained 4.51 percent.

Ayala Land, Metro Pacific, ICTSI and Globe also advanced by more than 2 percent while SM Investments, Security Bank and JG Summit were up by more than 1 percent.

Ayala Corp., SM Prime, BDO and Petron also contributed gains.

Outside the PSEi, notable gainers included newly listed companies Wilcon (+7.83 percent) and Eagle Cement (+2.3 percent).

On the other hand, GT Capital fell by 2.76 percent while URC was down by 1.48 percent as the tax package included an excise tax on sugar-laced beverages.

Megaworld and DMCI also slightly declined.