Main index continues downward trend; investors

The local stock barometer slipped for the second session in a row yesterday as investors lacked fresh incentives to load up on stocks.

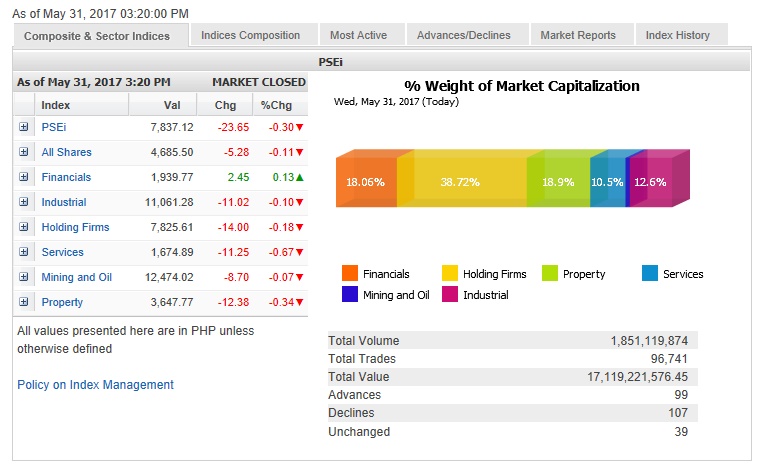

The main-share Philippine Stock Exchange index shed 23.65 points or 0.3 percent to close at 7,837.12.

Elsewhere in the region, stock markets were mostly up as data showing factory activity in China had grown steadily in May stood better than market expectations.

Except for the financial counter which slightly gained, all counters ended lower.

The sellers were mostly domestic investors as foreign investors were net buyers amounting to P572.4 million.

Article continues after this advertisement“Philippine markets cleaned their books on the last day of May. This was in tandem with US closing lower from multiple days of gains as oil prices declined and bank stocks weighed on the market. Investors also remained on the sidelines for the release of the Beige Book, June FOMC (Federal Open Market Committee) period,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

Article continues after this advertisementMeanwhile, a research note from Metrobank said local equities had failed to springboard from the recent announcement that Pres. Duterte had certified as urgent the first package of the government’s comprehensive tax reform plan.

Value turnover was heavy at P17.11 billion.

There were 107 decliners that edged out 99 advancers while 39 companies were unchanged.

The PSEi was weighed down most by Petron, which fell by 2.49 percent while PLDT, Ayala Land, ICTSI and Metro Pacific all slipped by over 1 percent.

GT Capital, SM Investments, BPI, Ayala Corp., URC, Metrobank and JG Summit all slipped.

One notable decliner outside the PSEi was Bloomberry, which fell by 3.09 percent.

On the other hand, AGI, Security Bank and Megaworld all gained over 1 percent.

SM Prime, BDO, Jollibee and Aboitiz Equity also gained.

Although the listing of Eagle Cement on Monday freed up some liquidity in the stock market, some investors were still tied up with the initial public offering of property developer Cebu Landmasters, which will list on June 2.

Underwriters reported oversubscription of the property developer’s P2.9-billion stock debut.