DOF: Keeping VAT exemption to benefit only ‘rich’ coops

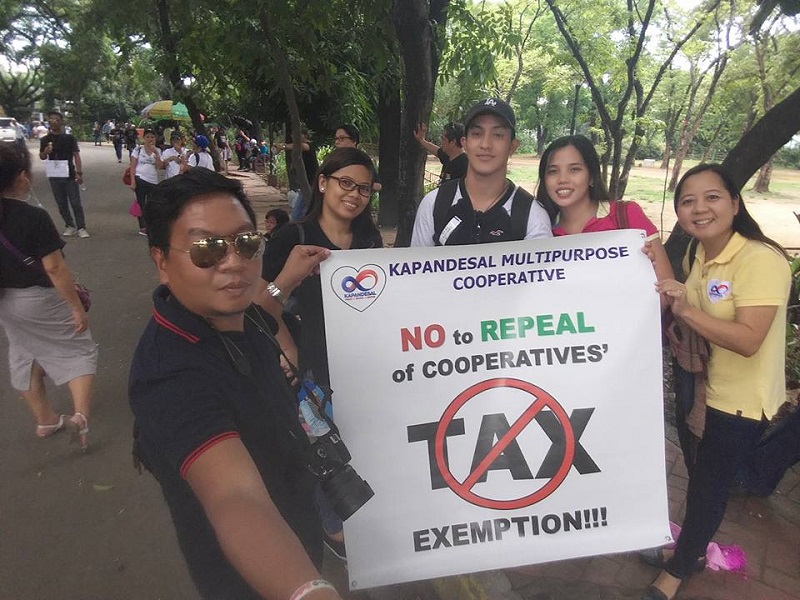

The Kapandesal Multi-Purpose Cooperative is among the many coops in the Philippines urging Congress to keep their exemption from the value added tax (RADYO INQUIRER FILE PHOTO)

MANILA — Keeping cooperatives’ exemption from the 12-percent value-added tax (VAT) would benefit only over seven million Filipinos, half of which belong to “rich” cooperatives, an official of the Department of Finance said on Thursday.

The 9,431 registered cooperatives in the country have 7.6 million members, of whom about 4.2 million “belong to rich cooperatives that have annual gross sales of over P5 million, according to Finance Undersecretary Karl Kendrick T. Chua who is quoted in a DOF statement.

At present, cooperatives enjoy VAT exemption, but the perk will be removed under House Bill (HB) No. 5636 or the substitute bill containing the DOF’s first tax reform package that was consolidated with other tax measures pending in Congress.

HB 5636, which was approved by the House ways and means committee on May 3, proposed to withdraw the VAT exemption from cooperatives, save for those selling agricultural products as well as those falling below the P5-million VAT threshold.

Chua said VAT-exempt cooperatives would instead pay 3-percent percentage tax.

However, a number of House members were moving to retain cooperatives’ VAT-exempt perk.

For the DOF, retaining cooperatives’ VAT exemption would be “grossly grossly unfair to the almost 100 million Filipinos who are non-cooperative members and have to pay their fair share of taxes.”

“The VAT leakage in this sector is big because the Cooperative Development Authority (CDA) cannot audit cooperatives properly and distinguish sales to members and non-members. There are also many fake cooperatives that take advantage of the system,” Chua said.

“Moreover, not all cooperatives are poor—some can be very rich,” Chua pointed out.

Citing CDA data, Chua said the only 750 “prosperous” cooperatives, or those with gross sales of over P5 million, in 2015 had a combined total income of P34.2 billion, excluding income from credit operations.

“On the other hand, 8,314 coops with gross sales of below P3 million earned only P3.3 billion, excluding income from credit operations, during the same period,” Chua noted.

“There are many ways to help cooperatives, but VAT exemption is not the right way as it goes against the principle of VAT. The VAT is a consumption tax and it’s wrong to use it as an incentive. It is not a tax on profit. We can use the budget to target their specific needs,” according to Chua.

Besides the Philippines, only Kazakhstan also provides VAT exemption to cooperatives. SFM