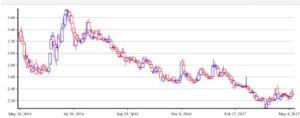

Specialty retailer SSSI Group has earmarked P200 million to buy back shares from the open market amid a downturn in share prices.

The budget for the buyback program was approved by SSI’s board, the retailer disclosed to the Philippine Stock Exchange on Wednesday.

“Management believes its shares are currently undervalued and that the buy back program will help to enhance shareholder value,” the disclosure said.

SSI is currently valued by the stock market at around P7.6 billion.

The company’s brand portfolio can be classified into five categories, namely: luxury and bridge; casual; fast fashion; footwear, accessories and luggage; and others. These include home furnishing and accessories, interior design items, food, and personal care. SSI represents over a hundred brands, including ”Hermes”; “Gucci”; “Salvatore Ferragamo”; “Zara”; “Bershka”; “Stradivarius”; “Old Navy”; “Lacoste”; “GAP”; “TWG”; “SaladStop!”; “Samsonite”; “Payless ShoeSource”; “Muji”; “Pottery Barn”; and “FamilyMart”.