Globe nets P3.76B

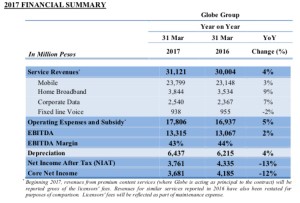

Ayala-led Globe Telecom’s first quarter net profit fell by 13 percent year-on-year to P3.76 billion on higher depreciation and interest expenses alongside one-time costs related to the purchase of San Miguel’s telecom assets.

Excluding the impact of non-recurring items, Globe’s core income stood at P3.7 billion in the first three months, lower by 12 percent year-on-year, as gains in cash flow were not able to offset the increase in depreciation expense.

The telecom firm nonetheless ended the quarter with record-level consolidated service revenues of P31.1 billion, 4 percent higher than the level in the same period last year.

“We are seeing encouraging improvements this quarter, despite the temporary setback on profits as we continue to lay down the foundation to secure sustainable growth in the future. Globe president Ernest Cu said. “Our continued aggressive network modernization and upgrades using the latest technologies are all geared towards enhancing our internet services, so that our customers can have a wonderful and seamless connectivity.”

Solid revenue growth across all data-related segments, as well as the continued subscriber expansion for both mobile and broadband, led to record-high service revenues. “Game-changing” initiatives including a digital lifestyle play, innovative offers and content partnerships with iconic global brands, backed by robust 3G and 4G networks nationwide also supported the growth, the company said.

Mobile revenues rose by 3 percent year-on-year to P23.8 billion on strong data consumption “as more customers adopt the digital lifestyle.”

TM, the company’s mass-market brand, registered 7 percent revenue growth from last year, while Globe Prepaid revenues improved by 3 percent from the same period last year. Globe Postpaid revenues, on the other hand, were flat year-on-year.

The company’s mobile subscriber base reached 58.6 million for the first three months, up by 2 percent year-on-year.

Mobile data remained the biggest contributor to total mobile revenues, now reaching 42 percent of total revenues during the quarter. Mobile data service revenues amounted to P10 billion for the quarter, up by 8 percent year-on-year, as mobile data traffic surged by 84 percent.

“The continuous ramp-up of data traffic and smartphone penetration only proves that Globe remains to be the network of choice of mobile data users,” the statement said.

Meanwhile, mobile voice declined by 3 percent year-on-year while SMS (short messaging system) or text messaging business increased by 3 percent.

The home broadband business likewise grew revenues by 9 percent year-on-year to P3.8 billion, driven by continued subscriber expansion, which now reached 1.19 million.

The corporate data business improved by 7 percent year-on-year to P2.5 billion, mainly attributed to the rising demand for data connectivity, customer base expansion, circuit count increase and higher usage.

Traditional fixed line voice revenues, however, posted a decline of 2 percent from same period last year.

Total operating expenses and subsidy grew by 5 percent year-on-year to reach P17.8 billion as Globe continued to invest in its data networks and support the growing subscriber base.

Despite the sustained revenue and cash flow growth, Globe said “the impact of higher interest expenses and depreciation charges from its network infrastructure investments, as well as Globe’s share in equity losses and spectrum amortization related to the SMC (San Miguel Corp.) telco asset purchase, weighed down Globe’s net income.”

Globe spent around P8.6 billion in capital expenditures in the first quarter to support its growing subscriber base and demand for data.