The local stock barometer slipped below the 7,700 mark yesterday as investors pocketed gains from the recent rally while a newly unveiled US tax plan failed to excite global investors.

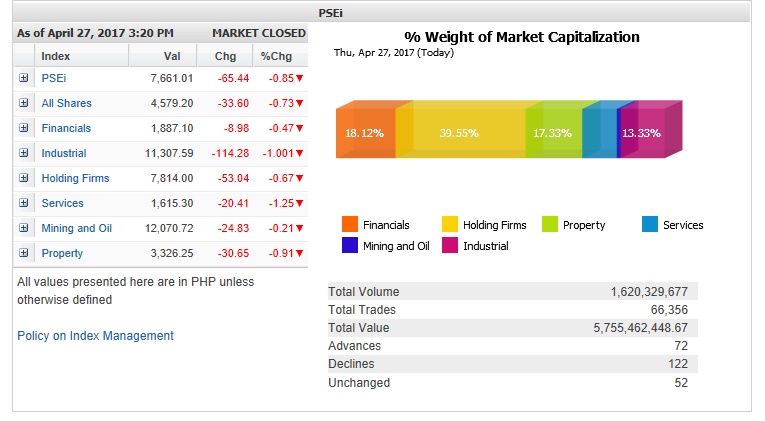

The main-share Philippine Stock Exchange index shed 65.44 points or 0.85 percent to close at 7,661.01, tracking mostly sluggish regional markets.

Raymond Neil Franco, vice president and head of research at Abacus Securities, said he believed that the local stock market was “fairly valued” and that investors can wait for better prices before coming in a big way.

Franco noted that in the fourth quarter of 2016, 40 percent of PSEi stocks reported flat or negative growth.

This year, he said consensus forecasts of a single-digit growth in corporate earnings may not be enough to sustain price-to-equity (P/E) ratios of 18 to 19x.

Abacus, he said, is projecting an average corporate earnings growth of 7-9 percent.

A P/E ratio of 18x to 19x means investors are paying 18 to 19 times the kind of money they expect to make from these stocks.

Franco sees the PSEi ending the year at 7,500, suggesting correction from current levels. He said it was even possible for PSEi to revisit the 7,400 key support level.

On the Philippine government’s tax reform program, Franco said this could be a downward risk for the market since a lot of hope had been built into stock prices.

“Deferring CTRP (comprehensive tax reform program) or allowing it to slide might be a disappointment for investors,” he said.

Yesterday, all counters ended lower but the most battered were the industrial and services sub-indices, which both slipped by over 1 percent.

Value turnover for the day amounted to P5.77 billion. Foreign investors were net sellers for the day amounting to P145.97 million.