The local stock barometer rallied to the 7,600 mark yesterday but pared gains at the close as investors turned jittery following the United States’ military air strike in Syria.

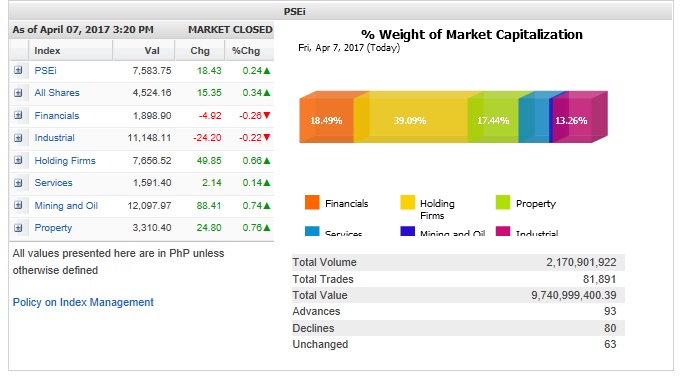

The main-share Philippine Stock Exchange index (PSEi) still managed to add 18.43 points or 0.24 percent to close at 7,583.75 after a bout of profit-taking.

The index hit a high of 7,667.33 but ended closer to the day’s low of 7,553.52.

“It looks like it was risk-off today as investors cashed out due to concerns of a retaliation against the US’ missile strike in Syria. While we ended up, it was way off the intraday high of 7,667—also the year-to-date high,” said Manny Lisbona, president of PNB Securities.

“Next week might see continued weakness, the magnitude of which will depend on what happens next between the US and Syria. Note that next week is also a short week, so trading will likely be subdued,” he added.

The US’ air strike against Syria, the first direct offensive against the regime of Bashar al-Assad, was in retaliation for a chemical weapons attack in Idlib.

Despite the tempered closing, foreign investors remained net buyers in the stock market amounting to P1.55 billion for the day.

The day’s modest gains were led by the holding firm, services, mining/oil and property counters. On the other hand, the financial and industrial counters declined.

Value turnover for the day amounted to P9.74 billion.

There were 93 advancers that edged out 80 decliners while 63 stocks were unchanged.

The day’s biggest PSEi gainers included Megaworld, which surged by 6.2 percent, and Jollibee, which gained 5.2 percent.

GT Capital, JG Summit and Metro Pacific Investments Corp. (MPIC) were all up by more than 2 percent while Security Bank and Alliance Global Group Inc. (AGI) both gained 1 percent.

Metrobank and PLDT also contributed gains.

On the other hand, Universal Robina Corp. (URC) tumbled by 5.44 percent after reporting a decline in profits while International Container Terminal Services Inc. (ICTSI) fell by 2.2 percent.

BDO Unibank slipped by 1.15 percent while SM Prime, BPI, Puregold and Ayala Corp. also declined.