Tax reform and the poor

The tax reform package being deliberated in Congress has a profound impact on our poor. This is because tax reform will provide the government the additional resources necessary to provide its people with essential services.

These services are sorely lacking in our rural areas. This is largely why our rural poverty is at 35 percent compared to 17 percent in Vietnam and 14 percent in Indonesia and Thailand.

The solution is a progressive tax package that should be passed this year. The last two tax reform schemes were passed 20 years apart in 1977 and 1997. This year marks the 20th year since. And we desperately need one today.

This will give the poor, mostly in the agriculture sector, the necessary irrigation, farm-to-market roads, post-harvest facilities, and other infrastructure they badly need to improve their productivity, incomes and welfare.

In addition, they should get the necessary education, health, and other government services for a better life. A statement coordinated by Filomeno Sta. Ana III was submitted at a press conference on March 13.

It read: “It is necessary for Congress to pass the reform package to bring tax relief to our workers and income earners and to generate the resources for public investments and infrastructure and the human capital to improve health, education, housing programs, and social services.” It was signed by Action for Economic Reforms, Alyansa Agrikultura, and the Foundation for Economic Freedom.

Article continues after this advertisementTaxing the Rich. Today, the tax structure is inequitable. The rich should pay more taxes, while the poor and middle class should pay less. This is the design of the proposed Personal Income Tax Package.

Article continues after this advertisementOther reform measures include increasing the excise tax on petroleum products. The top 1 percent of the population uses 13 percent of fuel products, while the top 10 percent of the population consumes 50 percent of the products. This is an obvious area for increasing taxes, especially since the basis used for computing prices is the year 1977.

Higher taxes on vehicles is another obvious choice.

The list of value added tax (VAT) exemptions should also be cut. While we have double the VAT rate of many countries, we collect less than half of what they do. This is partly because of too many VAT exemptions.

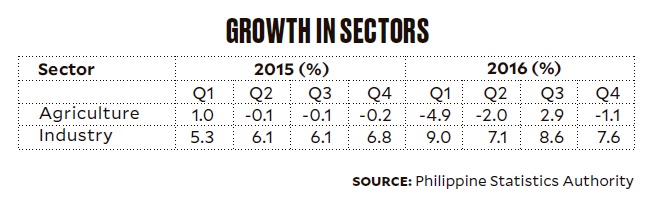

Agriculture needs bigger support from the government vis-a-vis the industry. Consider the table below:

In the last two years, industry growth averaged 7.1 percent, while agriculture declined an average 0.6 percent. Farmers and fisherfolk have complained they have not been getting the necessary support from their government. To help them, the government should collect more taxes from the rich who are not paying their share.

Farmer-Fisherfolk Position. This is why the Alyansa Agrikultura, a farmer-fisherfolk coalition of 42 federations covering all major agriculture sectors, has taken a strong position to support a tax reform this year. The alliance said it was not the agriculture industry’s fault it has fallen behind in terms of productivity. If our government would only give the same services that other governments give their farmers and fisherfolk, we would be much more productive and less poor.

The author is chair of Agriwatch, former Secretary for Presidential Flagship Programs and Projects, and former undersecretary for Agriculture, Trade and Industry.