PSEi rebounds on Wall Street upswing

The local stock barometer climbed back to the 7,200 mark Thursday as domestic investors took heart from the overnight upswing in Wall Street.

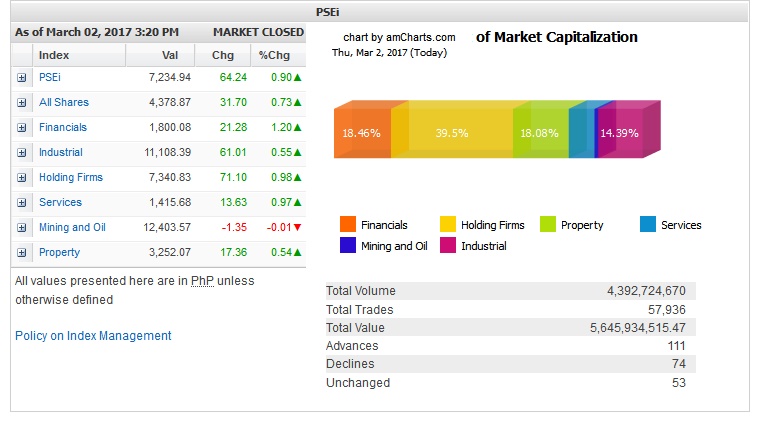

Rebounding from a four-day slump, the Philippine Stock Exchange index gained 64.24 points or 0.9 percent to close at 7,234.94.

“Philippine markets were bought heavily after the strong rally last night. US stocks rallied and the Dow locked in a 1,000-point gain to breach 21,000 for the first time as investors embraced the combination of a ‘more subdued’ President (Donald Trump) and decisively hawkish Fed commentary,” said Luis Gerardo Limlingan, managing director at Regina Capital Development.

At the local market, the day’s gain was led by the financial counter which rose by 1.2 percent. The industrial, holding firm, services and property counters also firmed up.

Only the mining/oil counter ended a tad lower.

Value turnover for the day was thin at P5.64 billion.

Market breadth was positive, with 111 advancers edging out 74 decliners while 53 stocks were unchanged.

AC gained 2.42 percent while ALI, BDO, MPI, Metrobank, GT Capital, ICTSI and PLDT firmed up by over 1 percent. SMIC, Jollibee and Globe also firmed up.

Outside of the PSEi, a notable gainer was Apollo Global, which surged 16.95 percent on the back of the backdoor listing plan of JDVC Resources Corp. JDVC is a P500-million domestic corporation set up to operate large scale high-grade magnetite mining operation in the province of Cagayan.

Leading canned food manufacturer Century Pacific also gained 2.33 percent.

SM Prime, Semirara and AEV slipped.

In the meantime, the peso further fell Thursday to a fresh 10-year low against the US dollar, closing at 50.31:$1 from 50.28:$1 on Wednesday.

Thursday’s close was the weakest since Sept. 26, 2006’s 50.32:$1.

At the Philippine Dealing System, the peso hit an intraday low of 50.345:$1 and a high of 50.27:$1 after opening at 50.3:$1.

The total volume traded declined to $409 million from Wednesday’s $429.8 million. —With a report from Ben O. de Vera