The local stock barometer slipped below the 7,200 mark Wednesday as risk-taking further waned following US President Trump’s address to Congress.

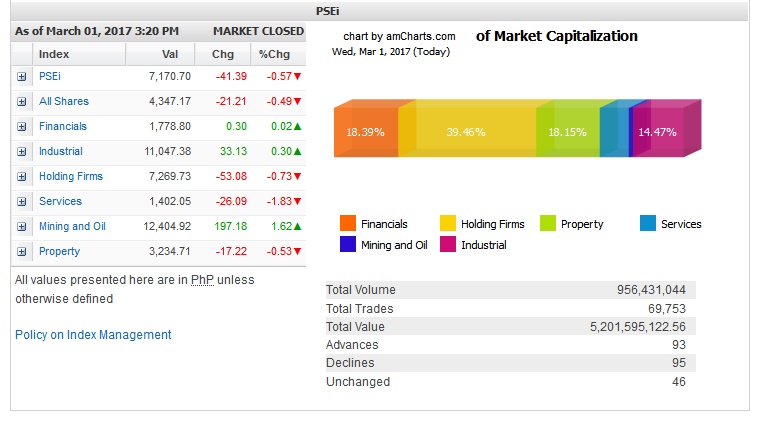

Declining for the fourth straight session, the main-share Philippine Stock Exchange index (PSEi) lost 41.39 points or 0.57 percent to close at 7,170.70.

“It looks like investors have been taking money off the table in anticipation of the effects of Trump’s address. Many are expecting the dollar to strengthen as an effect, which may push the BSP (Bangko Sentral ng Pilipinas), along with other central banks, to adjust rates upward to protect local currency values,” said PNB Securities head Manuel Lisbona.

In his first speech before the US Congress, Trump reiterated his plan to repeal the Obamacare health program alongside a $1-trillion infrastructure spending program, tighten immigration policies and build up its defense capabilities.

“Philippine stocks fell once again, this time along with US stocks, which closed with modest losses following several hawkish comments from several (US Federal Reserve) Fed presidents and the Dow snapped its 12-day winning streak as the market watched President Donald Trump’s speech,” said Luis Gerado Limlingan, managing director at Regina Capital Development.

The PSEi was weighed down by the services counter, which fell by 1.83 percent, while the holding firm and property counters also declined. On the other hand, the financial, industrial and mining/oil counter gained.

Net foreign selling stood at P813 million.

Value turnover for the day amounted to P5.2 billion.

There were 95 decliners that narrowly beat 93 advancers while 46 stocks were unchanged.

The PSEi was weighed down by PLDT, which slid by 4.11 percent while SM Prime and EDC both declined by over 2 percent. ICTSI and Metrobank both slipped by over 1 percent. AGI, SMIC, GT Capital and Ayala Corp. also declined.

On the other hand, Semirara gained 2.88 percent.

Metro Pacific rose by 1.47 percent after announcing a 17-percent growth in consolidated core net income to P12.1 billion.

Ayala Land as well as banking stocks Security Bank, BDO and BPI also firmed up. Security Bank announced a record-high profit of P8.55 billion for 2016.

Puregold gained another 0.22 percent ahead of its debut into the PSEi on March 13.

Outside of the PSEi, one notable gainer was Arthaland, which surged by 14.73 percent in heavy volume. Arthaland acquired a 4,000-square-meter property in Arca South.