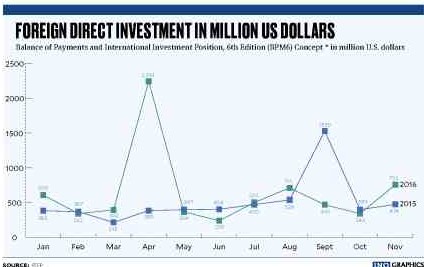

The amount of foreign direct investment (FDI) inflows in November last year peaked to a seven-month high such that the full-year target for 2016 was already exceeded during the first 11 months, Bangko Sentral ng Pilipinas data released showed.

As of end-November, the net FDI inflows totaled $6.97 billion, up 25.4 percent from $5.56 billion in the same 11-month period of 2015.

As such, the total FDI recorded from January to November surpassed the BSP’s adjusted 2016 target of $6.7 billion. The earlier goal for last year was lower at $6.3 billion.

In 2015, FDI inflows reached a total of $5.8 billion.

In a statement, the BSP said the continued FDI inflows were buoyed by investors’ confidence in the economy on the back of sound macroeconomic fundamentals and sustained growth potential.

“Net availments of debt instruments increased by 44.4 percent to $4.5 billion [from January to November] from $3.1 billion in the comparable period in 2015. In addition, net equity capital investments grew by 3.4 percent to $1.8 billion. This developed as gross equity capital placements of $2.4 billion exceeded withdrawals of $555 million,” the BSP said.

Most of the end-November equity capital placements came from Hong Kong, Japan, Singapore, Taiwan and the United States, the BSP said.

The bulk of the 11-month equity capital were poured into the following sectors: Arts, entertainment and recreation; construction activities; financial and insurance; manufacturing; and real estate.

Total reinvestment of earnings during the January-to-November period amounted $663 million.

During the month of November alone, net inflows of FDI reached $756 million, the highest monthly amount since April’s $2.24 billion.

Foreign investments in debt instruments or intercompany borrowings to fund existing operations as well as business expansion, which account for the bulk of FDI, jumped 193.8 percent year-on-year to $544 million in November.

The net inflow of equity capital during the month, meanwhile, dropped 34.7 percent year-on-year to $154 million. Equity capital placements registered an inflow of $437 million, up 77.9 percent, while the $283-million outflow was 2,780-percent higher than a year ago.

According to the BSP, the top sources of equity capital last November were Czech Republic, Germany, Hong Kong, Taiwan and the United States.

In terms of sectors, the biggest equity capital placements in November were infused into arts, entertainment and recreation; financial and insurance; professional, scientific and technical activities; real estate and wholesale and retail trade.

Reinvestment of earnings that month rose by almost a tenth to $58 million.