PSEi ends lower in cautious trade on US protectionist stance

The local stock barometer ended flat Tuesday as investors weighed newly inaugurated US President Donald Trump’s protectionist trade policy pronouncements.

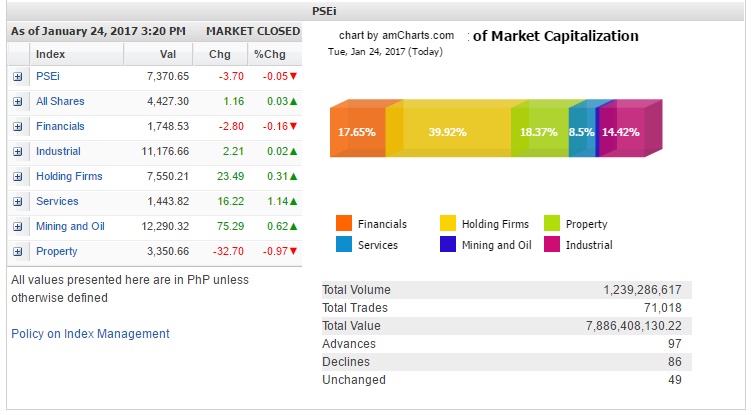

The Philippine Stock Exchange index (PSEi) shed 3.7 points or 0.05 percent to close at 7,370.65. Elsewhere in the region, sentiment was mixed after Trump signed a memorandum for the US to withdraw from the Trans-Pacific Partnership (TPP) and announced plans to renegotiate the North American Free Trade Agreement (Nafta).

With the US withdrawal from the TPP, BPI Securities president Michaelangelo Oyson said the Philippines would fare better than other countries given that its gross domestic product was domestic-driven and not dependent on exports.

“I remain bullish that we will hit 8,000 this year, likely in the first half. (Year) 2017 could be a year of two halves- (with) first half positive and second half a correction,” Oyson said.

He said tax reform would be a key to a re-rating of the Philippines, referring to a positive change in earnings outlook that would make investors accept higher price to earnings multiples.

Article continues after this advertisement“The bull market is not over,” Oyson said. “It’s time to buy when everyone is cautious. We see opportunities.”

Article continues after this advertisementAt the local market, the decline was led by the cyclical financial (-0.16 percent) and property (-0.97 percent) counters.

On the other hand, the services counter gained 1.14 percent while the industrial, holding firm and mining/oil counters also firmed up.

Value turnover for the day amounted to P7.89 billion.

Despite the PSEi’s slight decline, market breadth was positive as there were 97 advancers that edged out 86 decliners while 49 stocks were unchanged.