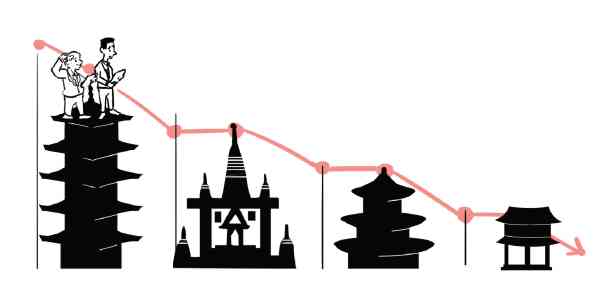

Do property investors in Asia need to worry?

Real estate investors in the Asia Pacific may have to brace for a challenging year ahead.

Rising interest rates, low economic growth, and global political developments are seen to create “uncertainties,” among investors, according to a report by property consultancy firm Colliers International.

“The economic picture for Asia Pacific looks darker than in recent years, with lower growth, rising interest rates and political upheaval in Europe and the United States being causes for concern for real estate investors,” Colliers International said in a statement.

“No investor likes uncertainty and two unexpected results—the United Kingdom voting to leave the European Union and the election of Donald Trump as US president—have caused widespread jitters,” it said.

Rising interest rates

Colliers International noted that while institutional investors will target the region’s property in 2017, rising interest rates and low economic growth meant investors have to work harder to get a viable return.

This is why rising interest rates is a major concern.

In December last year, the US Federal Reserve raised interest rates by a quarter point. A series of rate increases is expected between 2017 and 2019.

According to Colliers, the said hike is expected to affect residential developers as project costs may likely increase with the rise in the cost of debt. A decline in purchases from speculative investors is expected as they are more sensitive to higher borrowing costs.

Citing HSBC, Colliers International said Indonesia, the Philippines and India are likely to be more shielded from the “Trump effect” given low debt and low export exposures. In contrast however, Malaysia, China, Korea, Taiwan and Thailand are seen to be affected.

“We expect yields to remain pretty flat across most markets in Asia Pacific next year, with upward pressure from rising US interest rates and downward pressure from weight of capital cancelling each other out,” said Terence Tang, managing director for Asia Capital Markets and Investment Services at Colliers International.

Positive returns

The bright spot is that growth in some Asian economies still looked good.

As such, property investors in Asia are still expected to see positive returns on the back of a relatively strong gross domestic product (GDP) growth.

In most cities, property market growth is seen to come from economic growth, via rent increases. Investors are expected to look at value-added strategies, including ground-up development in emerging markets with better growth prospects.

Tang said a GDP growth of more than 6 percent is expected in both China and India. The Philippines is expecting a similar growth, while Indonesia is tipped to rise by over 5 percent. Japan’s growth is seen sluggish.

Robust growth

The Philippine real estate sector—in contrast to the regional trend—is seen to enjoy a more robust growth this year. This was on the back of an expected sustained economic growth in the next 12 months.

According to Colliers Philippines, it expected the country’s GDP growing between 6 and 6.5 percent annually over the next three years as macroeconomic fundamentals remain sound.

In the third quarter last year, the Philippine economy grew by 7.1 percent, outpacing other emerging economies in Asia.

Also expected was the surge in manufacturing investments, which would raise demand for industrial space. Firms are urged to start developing industrial parks outside of the Cavite-Laguna-Batangas area.

In its previous report, Colliers Philippines said public construction would be a major source of growth as the government committed to ramp up infrastructure spending, while private construction was seen to continuously grow due to sustained appetite for office and retail developments.

The business process outsourcing (BPO) industry and offshore gaming are likewise seen to drive the healthy growth of the local office property market this year, it added.

According to Colliers Philippines, the infrastructure plans of the incumbent administration would likely dictate the direction of real estate developments, even beyond the term of President Duterte.

The implementation of infrastructure projects nationwide should also provide access to land that could be redeveloped into mixed commercial, residential, hotel or leisure and industrial estates.