PSEi firms up at 6,900 level

The local stock barometer climbed back to the 6,900 level on Wednesday ahead of the closely-watched US Federal Reserve meeting, during which investors have priced in a decision to hike interest rates.

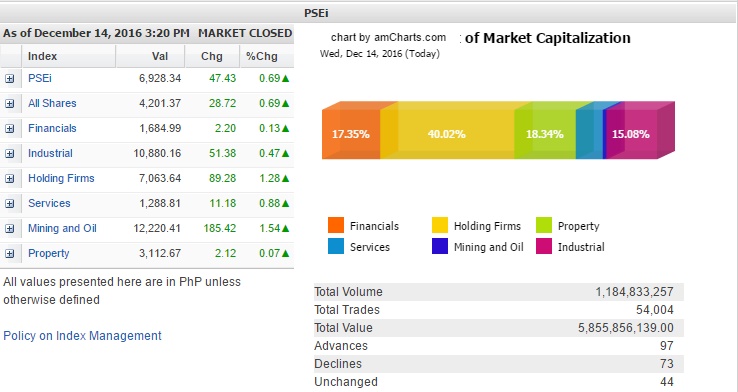

The main-share Philippine Stock Exchange index gained 47.43 points or 0.69 percent to close at 6,928.34, recouping some of the heavy losses incurred on Monday. The index has firmed up in the last two trading days.

On Wednesday, trading sentiment was mixed across regional markets as investors awaited the conclusion of the two-day Federal Open Market Committee (FOMC) meeting Wednesday night (Manila time).

“Our research team looked into 20-years worth of data to see how the PSEi performed around the FOMC meeting,” BPI Securities president Michaelangelo Oyson said.

Oyson said there was usually slightly positive movement on the PSEi the day after the Fed rate hike. “That is, the data indicate that the market generally prices in the rate hike ahead of time,” Oyson said. “Rate hike or no rate hike, it’s slightly positive on the market.”

All counters firmed up on Wednesday, led by the holding firms and mining/oil counters which both rose by over 1 percent.

Total value turnover amounted to P5.85 billion. There were 97 advancers that edged out 73 decliners while 44 stocks were unchanged.

Investors snapped up shares of conglomerates Ayala Corp. and San Miguel Corp., which both surged by over 4 percent while SM Investments Corp., Universal Robina Corp., PLDT Inc. and Bank of the Philippine Islands all gained over 1 percent.

SM Prime Holdings Inc., Semirara Mining and Power Corp. and Metropolitan Bank & Trust Co. also contributed modest gains.

On the other hand, Jollibee Foods Corp. tumbled by 2.33 percent after announcing the sale of one of its local brands in mainland China while Security Bank fell by 1.57 percent.

Ayala Land Inc., Aboitiz Equity Ventures, DMCI Holdings and BDO Unibank ended slightly lower.