After the surprising third-quarter Philippine year-on-year economic growth of 7.1 percent comes a string of economic growth upgrades by big financial institutions, some of which see the momentum continuing through next year assuming that the Duterte administration delivers on its promise to escalate infrastructure spending.

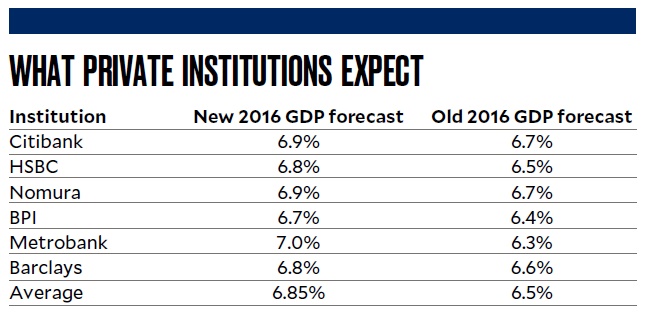

At least six big financial institutions have upgraded their gross domestic product (GDP) forecasts for the country this year to levels averaging 6.85 percent, rising from the same institutions’ average growth outlook of 6.5 percent in the previous quarter. The forecasts ranged from a high of 7 percent to a low of 6.7 percent.

In a research note written by economist Jun Trinidad, Citi jacked up its full-year growth forecast to 6.9 percent from 6.8 percent while retaining the estimate of 6.8 percent for 2017, still banking on resilient domestic demand.

“With Duterte’s policy agenda still firming up along with a slumping Philippine peso, rising yields and falling equities, real investments probably ended 2016 on slower double-digit gains,” Trinidad said.

“Domestic demand story remains intact in 2017 but we maintain a sober outlook with intensifed financial market volatility and risks associated with US President-elect (Donald) Trump’s policy agenda,” he said.

Ayala-led Bank of the Philippine Islands (BPI) revised its full-year GDP growth outlook to 6.7 percent from 6.4 percent, economist Emilio Neri Jr. said, adding this was “on the resumption of national government spending ramp-up and surges in manufacturing and capital spending mostly propelled by faster vehicles production and demand in fourth quarter.”

In the third quarter, Citi’s Trinidad noted that the robust growth defied the post-Philippine election fiscal slowdown.

“Base effect and government transition should dictate the pace of total fourth-quarter fiscal expenditures but, on balance, private spending should still lead the way. The slow transition, with many senior government posts still without appointments, may finally take its toll on public expenditures in the fourth quarter in our forecasts, such that GDP may depend largely on fourth-quarter private spending gains. Just like in third quarter, food and beverages may provide the upside during the festive quarter, with the peak of discretionary spending behind us,” Trinidad said.

Barclays upgraded its full-year GDP growth forecast to 6.8 percent from 6.6 percent while also raising its 2017 growth outlook to 6.8 percent from 6.3 percent, noting that an easy monetary policy and an expansionary fiscal stance should continue to support economic expansion.

On the expenditure side, private consumption continued to underpin growth, rising by 7.3 percent year-on-year in the third quarter, broadly similar to the growth rate in the second quarter.

“Government spending weakened in the third quarter, rising only 3.1 percent year-on-year, likely reflecting the transition to a new administration. Strong gains in investment continue, with another quarter of double-digit growth [of] 20 percent year-on-year, which pushed the year-to-date rate to 24.2 percent,” it said.

Barclays noted that overall trade activity remained a drag, paring GDP growth by 3.5 percentage points in the third-quarter GDP growth number. By industry, a big turnaround was noted in agriculture production (+ 2.9 percent) while services also grew faster (6.9 percent).

Nomura raised its 2016 growth forecast to 6.9 percent from 6.7 percent. “Government consumption indeed slowed sharply but private consumption and investment spending remained solid in the third quarter. Within investment spending, construction activity accelerated further in the third quarter, led by the private sector. This reinforces our view that the quality of growth is improving and is likely boosting medium-term potential growth.”

HSBC tweaked its 2016 GDP forecast higher to 6.8 percent from 6.5 percent, adding that momentum would likely continue into 2017 on the back of infrastructure spending and resilient remittances.

“The election of Donald Trump introduces some risks to growth due to the possibility of protectionist policies, but we believe risks to the Philippines are manageable and more limited than elsewhere,” HSBC said in a research note.

The biggest risk comes from the business process outsourcing (BPO) sector, which employs around 1.2 million Filipinos and earns around $21-22 billion a year, out of which the US contributes about 70 percent.

“We think risks are mitigated because there is little direct competition with American workers and President Rodrigo Duterte appears to have struck a more conciliatory tone concerning future cooperation with the US,” HSBC said.

Metrobank is the most optimistic among these institutions, upgrading its full-year growth forecast to 7 percent from 6.3 percent previously.

“The plans for massive infrastructure spending by the Duterte administration is seen to further boost investment spending growth. The sustained expansion in investment spending is expected to shield the domestic economy from negative externalities and form the backbone for a more inclusive growth,” Metrobank said.

Meanwhile, Metrobank said the weakening of the peso meant that overseas Filipino worker-supported households would have greater purchasing power this Christmas season. “This will keep fourth quarter consumer spending on an uptick, providing some counterbalance to base effects from last year’s strong yearend finish as well,” it said.